I am a landlord and also have a full time job. I also spend my time fixing my units.

With the maintenance cost and taxes, I’m actually losing money or breaking even depending on the year.

My tenants are living in a house that they wouldn’t be able to afford on their own in today’s market. Being able to live near their work.

So why am I the bad guy?

With the maintenance cost and taxes, I’m actually losing money or breaking even depending on the year.

My tenants are living in a house that they wouldn’t be able to afford on their own in today’s market.

Literally the hottest real estate market in history, after we just came out of the lowest interest rate market in history, and my man up here still can’t even break even on a residence he is renting out to someone else out of the pure kindness of heart.

Maybe you are the rare, golden One Good Landlord, or maybe you’re just some asshole on the internet posting utter bullshit. Who can say?

But I’ve never met any landlord like you IRL. Hell, I’ve never actually met a landlord who owned the property I rented. They always went through property management companies that do all the work for the owner and just forwarded on a chunk of my rental payment at the end of every month.

I do accounting for a lot of landlords. What he’s talking about is cash flow. Almost nobody ends up with taxable income from renting because the rent goes to the mortgage, property tax, insurance, maintenance, etc.

Before you crucify me on a barbed wire Popsicle stick, the part he’s leaving out is the equity he’s building at the tenant’s expense.

When he eventually sells the place, he’ll get hundreds of thousands of dollars that didn’t cost him anything. Whoever lived there just gets memories of that place they used to sleep in.

Almost nobody ends up with taxable income from renting because the rent goes to the mortgage, property tax, insurance, maintenance, etc.

Some of the highest grossing dividend stocks on the market are from REITs. Those dividends are coming from somewhere.

the part he’s leaving out is the equity he’s building at the tenant’s expense.

Sure. They’re paying both the interest and the principle, and they’re not seeing any of the appreciation of the underlying asset. I wouldn’t even call this “at their expense” as there are some risk-benefits to renting (namely, no exposure to liability of the building loses value or falls apart). But its very obvious he’s not suffering for this arrangement.

He’s just not price gouging, either.

Which is probably the best case scenario in any kind of landlord-tenant relationship.

We own 3 rental properties. 1 we bought from my wife’s grandpa because he was about to sell it to one of those “we buy houses scams” and we’re currently renting it out for about 60% the rent on comparable properties…tenets have been great except for a few months several years ago when dude got hurt and couldn’t work. We worked with them through that, and they haven’t been late since or caused any damage. The other 2 are friends/family that couldn’t afford a place on their own, so we bought it, and they rented it. We generally lose money on those 2. I grew up poor, and we had to move every year or two when we got evicted or when we were actually doing things right, but the landlord wasn’t paying the bank.

There’s a lot of scummy landlords out there, but there’s several of us who aren’t. We charge just enough to cover mortgage and maintenance. The payoff comes after we retire. We can sell the homes (hopefully to the tenets if they’re interested) or supplement our retirements.

I mean, cool. You’re The One Good Landlord who is doing everything at cost and simply extending your credit to friends and family. I suppose I never found this kind of place, because I wasn’t immediate family or friends with someone who could buy and let property to me under their credit scores.

We charge just enough to cover mortgage and maintenance.

That’s not traditionally how the good folks at Brookfield Properties or Invitation Homes do things.

The payoff comes after we retire.

So its less that you’re not making money, and more that you haven’t realized your gains.

So basically someone else is paying your mortgage and giving you equity without generating any equity themselves.

We charge just enough to cover mortgage and maintenance

So your tenants would be able to do that themselves if they were able to buy the property instead of renting it.

The payoff comes after we retire. We can sell the homes (hopefully to the tenets if they’re interested) or supplement our retirements.

Which is what you are taking from your tenants in exchange for…?

It’s really easy. If you’re breaking even, then it’s not worth it to hang on to the property. Unless you enjoy being called on a Sunday afternoon to fix a toilet.

If you are making a profit, then you’re stealing income from your tenants that could be used to buy their own home.

You’re not charging market rate for your property and are giving discounts to friends and family?

You’re a bad capitalist and need to go to capitalist jail (which is like… I don’t know, a Betty Ford clinic to “get clean” and definitely not “do cocaine with other landlords”?)

Dude he’s losing money year on year and capital gains carry it through to make it profitable longer term. The problems isn’t “landlords make a profit”, the problem is “speculative investors are removing housing stock driving up costs”.

Through that lense this guy is no saint.

the problem is “speculative investors are removing housing stock driving up costs”.

In this particular highly-niche scenario, he’s got housing stock that he’s letting at-cost to people who would otherwise be somewhere else in the housing market. So its a push.

The “speculative investors removing housing stock to drive up costs” folks tend to be corporately owned and industry coordinated properties that deliberately keep units open above the clearing rate, in hopes of driving up the prevailing cost of new housing.

Through that lense this guy is no saint.

He’s not saint. He’s just a guy who is giving close personal friends a place to live at-cost. Which would be fine, if this kind of service was available to everyone. Its just that he doesn’t have enough friends or enough units to clear the national backlog.

The “speculative investors removing housing stock to drive up costs” folks tend to be corporately owned and industry coordinated properties that deliberately keep units open above the clearing rate, in hopes of driving up the prevailing cost of new housing.

This is dependant on the market (the post didn’t say where they are), but I understand is true in the US.

In Australia, the speculation is driven by individuals who get incredible tax incentives if their income is above a certain level. Because of this, the housing market is distorted to the point where housing values are detached from rent potential, with all the value being driven by capital gains and tax offsets. This further leads to a situation where it’s often more economically viable to leave a house empty (and therefore not have to maintain the property or deal with tenants) while the value grows and the tax is written down.

This further leads to a situation where it’s often more economically viable to leave a house empty (and therefore not have to maintain the property or deal with tenants) while the value grows and the tax is written down.

Functionally what happened in East Asia, with “Investment Property” glut leading to the Evergrande bankruptcy, the current Seoul real estate bubble, and the 1990s Chiyoda-ku bubble which valued downtown Tokyo at a higher price than the entire nation of Canada.

Housing reform has been on the menu across the Pacific Rim for decades, thanks to the bid-price of land wildly outpacing its utility value.

I mean he still owns the fucking property after his tenants have paid it off.

Idgaf if he is doing this out of the kindness of his heart, still a land bastard.

deleted by creator

Yes, let’s pretend that housing prices haven’t gone up (lumber shortage, pandemic, what are those things?!)

And let’s live in a world where interest rates haven’t changed in the same time period (2.75% APR should be about the same as a 7% APR mortgage!).

Lastly, let’s ignore closing costs and the huge hunk of money realtors, banks, title companies, surveyors, and so on make every time a home is sold.

The main issue folks have with those generic “fuck all landlords!” posts is that while yes, corporate landlords that monopolize housing and keep raising rents in lockstep and invent fees suck ass, there’s also folks who found it easier to rent right away vs keeping an empty house on the market. Those landlords are paying a 10 year old mortgage with 10 year old lower interest rates, but 2024 property taxes and home insurance.

10 year old mortgage for a home at 2014 prices + current property taxes and insurance + 10% profit margin (the horror) << Brand new mortgage on the same home at 2024 prices and 2024 APR + insurance and property taxes.

Oh and I forgot about mortgage insurance. The person renting their home likely has gotten their mortgage below the cutoff for requiring mortgage insurance.

There are many situations where both the person renting their home and the renter come out way ahead.

The only ones who win by forcing everyone to sell their homes and no longer rent are the banks (more closing costs, prey on folks who aren’t ready to buy a home with high APRs and mortgage insurance, get to close out low APR loans for new higher APR loans), real estate agents and everyone that gets a cut Everytime a home is bought and sold.

That said there is something that can be done for the big investment groups that are buying up homes to jack up prices and corner local rental markets.

lumber shortage, pandemic

you listed two artificial increases in property value, sure lumber was more expensive, that was due to lumber tarrifs under the trump administration.

Sure covid had an effect on newly built houses. We’re well past that stage, that should be normalized by now. We should’ve had a massive surge in house building post restriction, but we didn’t.

Those people are able to live in the house you took off the market (thus driving up the price of housing) and pay off your mortgage.

Are we talking about eliminating renting altogether?

Cause that is what it sounds like in this thread. Folks wanting to completely eliminate renting and drive folks to buy a house Everytime they move.

This ignores things like closing costs, realtor fees, really high property taxes, expensive home repairs, and temporary work assignments.

Maybe you really need a job but don’t want to straight up buy a house and instead rent something until you can find a job back in your local area or you decide it’s time to take the plunge and move for good.

Sure there are many a-hole companies and landlords that try to squeeze their tenants for every dime and treat their tenants like crap (lord knows I’ve run into those), but on the other hand there are folks who need a place to live but haven’t decided where they want to settle down and people who can rent their old property at a decent date based on the low interest they themselves were able to lock down.

Some are folks (like me) who moved but couldn’t afford to keep their house empty for an extended period of time to put it on sale while they’re paying rent or a mortgage in another state. So renting, even if you’re barely breaking even, makes sense.

Better to rent your old house for barely above the costs for the property taxes, homeowners insurance, and mortgage interest, and maintenance costs than to take a 6-12 month hit where you have to pay the above while not living in the house because your new job is in a different state. And that is if you sell in 12 months and don’t take a big hit on the sale.

If you’re buying/selling a house every 3 years then you’re really going to get screwed. I personally went from living in a home I owned (and paying a mortgage on) to renting for 3 years just to understand where I wanted to live in a new state, which areas had the best employers, and wait out on a low APR and decent buyers market.

If I had to buy a house instead of having the option to rent, then I would have ended up buying a house near that employer which would have been over an hour commute from the better job offers I got after I moved here.

Nobody is saying to “get rid” of home rentals, but they are saying get rid of landlords.

Particularly for SFR homes, there’s no reason for a person who is not living there to ‘own’ the property and extract rent. For those who are transient -as you described- there are community land trusts, cooperative housing, limited equity housing coops, and municipal housing that can all fill the role that would traditionally be done by private landlords. Those of us who advocate eliminating private home rental’s for profit do so knowing it wouldn’t happen by choice, and that alternate arrangements for housing would need to be established alongside any legislation that bans for-profit rentals.

Private landlords are systemically problematic because it inflates home values and locks an increasing portion of the population from the option of building equity (or benefiting from community equity, as it were). Nobody is saying you’re a bad person, only that landlords (the category of private capital ownership that collects rent for the use of property) are perpetuating a huge problem and ought to be banned as a matter of benefiting society as a whole. Just like how towns or neighborhoods are democratically governed, homes should be too.

I knew I liked you.

Thanks for sharing alternatives to the status quo. See a lot of people complaining in this thread without proposing what the new system would look like. Guess it’s easier to do that though

Are we talking about eliminating renting altogether?

I’ve asked this very question before on reddit in a genuine attempt to understand what alternative the anti-landlord crowd is advocating for. Aside from the onslaught of personal attacks on my character, the best I could decipher was some sort of system where a landlord could only rent at actual cost of their mortgage, taxes, insurance, maintenance, etc. No profit could be earned. I said no one would be a landlord for free, especially considering the risks of owning land (natural disasters not insured, market crash, etc).

Their “landlords shouldn’t profit off of renters” argument fell apart when I asked profit for who? Was the bank allowed to make a profit on the home loan? Was the insurance company allowed to make a profit on the policy? Could the maintenance and repair folks earn a profit on their services? Could the home remodeling companies make a profit if the home needed updating? Or is every person and entity involved in home ownership allowed to profit from the rental except the landlord? They stopped responding.

Seeing the same thing here. Apparently I’m scum because I’m renting my previous home for -10%/+10% of: mortgage on the lower price I paid 10 years ago, plus property taxes, plus home owners insurance, plus repairs and maintenance.

Apparently I would no longer be scum if I stopped renting it and refused to renew my tenants lease, sold the house and made a huge profit now, and the next person will have to pay brand new closing costs plus a mortgage on double the home value and double the APR.

I’m guessing most folks down-voting the sane responses saying rentals aren’t needed have never tried selling a house (and gone 6+ months paying the mortgage for a house you no longer live in) or don’t know there’s a “break even” calculation that tells you how many years you have to live in the same house before you’re better off than having just rented (realtor fees to sell the house, closing costs, time to sell the home where you’ll still be paying your mortgage + taxes + insurance, time to close, getting credit approval for a mortgage, etc).

Hell, I did the calculation when I had to move to a new state and I was able to rent a house for less than it would have cost me to pay for closing costs and realtor fees when I would have sold the house 3 years later. Not to mention the time to come up with 20% down payment.

But fuck me for not taking the easy way out, kicking out my tenants and cashing in on the current huge property values to sell my old home.

Again: nobody is saying you’re scum, they’re just saying it would be better if we didn’t have landlords.

But if you like to play the victim go off I guess

Maybe follow the thread?

https://lemmy.world/comment/9580949

Edit:

it doesn’t make you a martyr to barely break even, it still makes you a parasite.

Idk what you meant to link to there but I saw no personal attacks

Housing should be socialised, with any profits being put back into expanding housing stock.

Whose profits? See my post above:

profit for who? Was the bank allowed to make a profit on the home loan? Was the insurance company allowed to make a profit on the policy? Could the maintenance and repair folks earn a profit on their services? Could the home remodeling companies make a profit if the home needed updating? Or is every person and entity involved in home ownership allowed to profit from the rental except the landlord?

If your answer is “anyone and any entity making a profit”, then that’s about two or three dozen different industries (including banks, insurance agencies, title companies, all kinds of home builders, repair folks, etc.). Regardless of my opinion on that argument, your problem isn’t with the landlord, it’s with a huge swatch of industries who are all tied to and profit from renting.

including banks, insurance agencies, title companies, all kinds of home builders, repair folks

It’s only the profit derived from ownership that’s of concern here, none of these other industries (aside from the bank, arguably) apply to the critique.

I’ll just copy paste my response from above.

Nobody is saying to “get rid” of home rentals, but they are saying get rid of landlords.

Particularly for SFR homes, there’s no reason for a person who is not living there to ‘own’ the property and extract rent. For those who are transient -as you described- there are community land trusts, cooperative housing, limited equity housing coops, and municipal housing that can all fill the role that would traditionally be done by private landlords. Those of us who advocate eliminating private home rental’s for profit do so knowing it wouldn’t happen by choice, and that alternate arrangements for housing would need to be established alongside any legislation that bans for-profit rentals.

Private landlords are systemically problematic because it inflates home values and locks an increasing portion of the population from the option of building equity (or benefiting from community equity, as it were). Nobody is saying you’re a bad person, only that landlords (the category of private capital ownership that collects rent for the use of property) are perpetuating a huge problem and ought to be banned as a matter of benefiting society as a whole. Just like how towns or neighborhoods are democratically governed, homes should be too.

You still didn’t answer the question. So get rid of the landlords means what exactly? You realize there’s about two dozen or so industries whose entire commercial existence is tied to landlords and rental properties, right? Do we get rid of all of them? Or just some? Or just the landlord, who is one small cog in a very big capitalist renting wheel?

Everyone is so oddly and furiously fixated on the landlord as some sort of big bad, and therefore assert that getting rid of the landlord position entirely will just magically make everything awesome. It’s odd to observe otherwise intelligent people stop so outrageously short of the complete picture.

You still didn’t answer the question.

Actually, I think I did, you just didn’t understand it. What we mean by ‘landlord’ can be essentially boiled down to ‘private ownership’. The problem with landlords as a class is that they exert complete control over a ‘property’ while having the least use of it. When Adam Smith wrote about ‘rent extraction’, he was specifically identifying a portion of an economy that was unproductive.

Landlords are defined by their ownership; they could also maintain the property, but what makes them ‘landlords’ and not ‘maintinence workers’ is their ownership over a property someone else is using and charging rent for that use. The other arrangements I listed in my previous comment address that inefficiency by democratizing the use of that asset, instead of allowing the monopoly of the landlord.

It’s odd to observe otherwise intelligent people stop so outrageously short of the complete picture.

I would really have to agree.

Actually, I think I did, you just didn’t understand it.

No, you didn’t. And the drivel you just wrote still didn’t answer the question. At this point it’s clear that it’s intentional.

The problem with landlords as a class is that they exert complete control over a ‘property’ while having the least use of it.

Tell me you have no idea how property ownership works without telling me you have no idea how property ownership works.

I would really have to agree.

“No you”. Nice one. Good luck friend, this back and forth is pointless.

deleted by creator

Your question is literally answered in a sibling comment.

Fuck no, just the landlords. Housing should be socialised.

Its important to remember that in your example of “barely breaking even” some poor schmuck is paying off your mortgage. So it doesn’t make you a martyr to barely break even, it still makes you a parasite.

Buying house for say 100k at 3% APR, renting it because you were laid off and cant afford moving expenses, rent in a different city, plus paying a mortgage on an empty house for 6 months to a year while it sells. Then years later you still keep it because, while you could sell it and cash in, with the low APR you got on it you can afford to rent it for less than the corporate scum suckers who try to monopolize housing = Parasite

Kicking out your renters and selling said house you bought at 100k for 200k to corporate scum suckers who will turn around and sell it at an even higher price or rent it at really high rates OR someone else who will end up paying way more than the rent I was asking for the place because interest rates are about double and the house has also doubled in price = internet hero

No room for nuance, got it.

If you move or can no longer afford your house, the property should be absorbed into a community coop (or sold to them) and leased back to the tenant or a new family. You keeping ownership of the home is not a requirement, it’s actually a huge problem.

The only ones insisting on the alternate scenario you just described are landlords who think of themselves as martyrs.

If we remove landlords from the picture, we get a bunch of housing on the market.

I own my own home now, but I’ve rented in the past. Eliminating rentals is an awful idea.

I moved a lot when I was younger: for education, jobs, etc. Buying a house every time I moved (knowing I was likely in an area temporarily) would have been a fucking nightmare – rentals fill a legitimate need.

Sure: fix the problems of price gouging and profiteering. Put strong limits on the number of single family homes one can rent, and outright stop corporations from buying single family homes. Increase protections for tenents and drive slumlords and absentee landlords out of business. But the idea of “just buy a house, lol” is absurd.

Nobody is saying “just buy a house,” because everybody is complaining about how the lack of housing is a major part of the issue. Apart from what you said on imposing limits and increasing protections for renters, the other main issue is to diverge equity from housing. Having the main way to accrue wealth be tied to the basic necessity of having a roof over your head puts a major incentive on people and corporations to buy up property. Housing becomes an investment at that point, not a service. There are people and companies sitting on empty houses because driving up the market by removing inventory is a more profitable investment than actually renting them out.

And if there were more options besides single family housing, people wouldn’t be forced to buy a house every time they moved as well. The US especially is really bad at this. We have high density apartments and condos, and single family homes, but a major lack of medium density housing. If we had more multi-family homes, duplexes, town houses, and smaller scale apartment and condo buildings, this would be a lot less of an issue. With more variety in housing types, the demand for single family homes would be a lot less and would help to reduce housing prices and make things more affordable for those who do want to buy a house.

That doesn’t mean we get a bunch of people with down payments and higher wages to afford these properties though. Housing prices would need to fall a lot for that to occur and if it did, it’d put many of the people who were able to scrape together the money to buy a house underwater on their mortgages.

If you’re losing money with your properties, why not just sell them to your tenants for an affordable price?

Because they aren’t mentioning the part where the value of the house is way more than what they have invested and they will make a fortune if and when they sell lol. I lose money each year on this! But the property value is through the roof and you can borrow against it and get cheaper rates than everyone else.

Because he has unrealized capital gains - in yearly income/expenditure their losing money but big picture, when they sell, they profit.

In Australia, rental returns are paltry (less than 2%) compared to any other investment, but steep tax concessions on and insane capital growth (often higher than 6% annually) incentivises speculative investment in real estate… This is what’s driving up the cost of housing to the cartoonist levels they currently are in. It’s not unusual for these speculators to not even bother with tenants, because like op suggests they often lose money maintaining the property, it’s cheaper to speculate and maybe renovate immediately before selling.

The problem has nothing to do with landlords and everything to do with speculators going for capital gains. Greedy landlords can be a problem where there are no rentals protections, but that can easily be resolved with regulation.

I don’t know which particular Market you’re in, but in the majority of cases, especially around me, if a bank would just fucking approve me for a loan I would pay notably less per month then I pay a landlord for rent.

And it’s not like I even have a bad credit I’m in the 740s but since the fake imaginary value of properties is skyrocketed to the point that even a piece of shit falling apart house is almost a million dollars I can’t get the kind of down payment they want. So despite the fact that the mortgage would literally be cheaper per month I can’t get one.

And that situation exists thanks to people snapping up properties especially large companies and turning them into investment rental properties

My tenants are living in a house that they wouldn’t be able to afford on their own in today’s market.

Yes, but: why is the market in the state it’s in? It couldn’t be because a large supply of housing is locked up by landlords, thereby artificially curtailing supply and driving up prices…

You sound honest, but usually the internet speaks of generalizations. You may be an exception to that norm.

Otherwise; no, you don’t sound like the bad guy

The big corps making profits is what the post is about, I think.

…but usually the internet speaks of generalizations.

Oh boy does it.

I find it hard to believe you’re losing money, unless you don’t understand the economics of it. If your mortgage payment is £450, and rent is £450 that’s an even ratio, of course you have maintenance costs on top of that, so it looks like you’re down X amount on costs but you’re not, you’re up £450 - maintenance. But I seriously doubt you’re charging Equal to your mortgage payment anyway.

I don’t think this is a particularly fair take. Some people bought at high prices because it seemed like the right move (in 2008, for example), market crashes, you’re stuck with your investment even if you’re underwater (upside down).

It’s definitely not fair to assume what his costs are compared to the cost to rent. It isn’t necessary to have the example above to reside in an area where mortgages far exceed rent. Northern Virginia in the USA is a good example, where townhomes can easily exceed 1 million USD, which would typically require a 30-50k+ down payment plus closing costs, and would then be 5k+ in a mortgage. Rent that place for 4500 and that’s a loss on monthly costs, but of course the landlord is earning long term equity (and that is the value, but they may not be turning a profit).

Edit: I’m simply stating that it’s unfair to assume the original commenter is lying about not making a profit. I’m not suggesting they aren’t experiencing a net gain in equity.

Really weird way to run a charity. I think youre lying

Everyone needs housing to live, and housing is increasingly being treated as an investment vehicle by the rich. In many markets, this has decoupled the monetary value of housing as an investment from the use-value it provides normal individuals, causing home prices to increase rapidly.

To your point, our current economic and credit situations have caused home ownership to be essentially impossible for a large number of people. Since home ownership is one of the primary ways individuals can build wealth, this has made it significantly harder for the average family to build wealth - trapping them in debt, making it much harder to save, etc. This is bad for society and for the economy, not to mention inhumane and harmful to millions of families in the US alone.

So, while renting is a necessity in our current economic climate, it is only a necessity for so many due to predatory economic factors preventing them from entering the housing market. Landlords, while necessary in this system, are increasingly corporations rather than individuals, and they are buying up huge swathes of the total available housing - causing increased housing scarcity, pricing more people out of the housing market, and increasing the number of people forced to rent. Individual landlords, as well as landlord corporations, are exploiting the system for profit and either perpetuating the current predatory housing system or (in the case of corporate landlords) deliberately making the system worse for profit, economically harming millions of families and individuals.

So that is why people see landlords as “the bad guy”. Whether or not you in particular treat your tennants decently, you are part of a predatory system and are working to perpetuate that system. It is an interesting moral and ethical dilemma because the system we are forced to exist in creates the necessity for landlords (as you said, some people have to rent), but that same system created the conditions that force so many people to be lifeling renters.

i’ve never fucking understood why people consider housing to be an investment, it’s a fucking assest.

even land isn’t an investment, why the fuck would a house be an investment.

Because the value of housing goes up over time. Practically guaranteed, historically speaking. An asset is just a thing that has value. An investment is an asset that (you hope) will accrue value in the future. Land can be an investment, too. So can digital pictures of monkeys. Really, any asset can be an investment.

yeah but that’s like, entirely counter to the core concept of how this shit works.

And old house is not more valuable than a new house, unless new houses are getting shittier and shittier over time, which last i checked, they aren’t.

I would classify an investment as the explicit example of putting money into something, that you expect to do well, in such a manner that you can realize returns on that investment, normally this does not entail using something. Buying a house, and then living in it for example, is not an investment. Much like buying a car, driving it, and the selling it, generally does not make you money. It can if you hit the market in certain places at certain times, but this is more speculative investing than anything.

And again, shouldn’t apply to houses on account that there should be like 100 million houses in the US at the very least, any time where speculative investment becomes a thing, it’s because there is low supply, and high demand. This literally should not be possible for housing. And if it is, it’s about as moral as trading people for money.

Oh yeah for sure. The fact that houses are allowed to be investments is obscene

gotta love economics, i still fail to see how housing is any different than a car, and the fact that they’re treated differently is just weird.

From your description it sounds like land lording isn’t working for you. Why not sell?

It’s still worth it for appreciation and 1031 exchanges.

Are landlords really that bad?

JT for the win. 🏆

If you weren’t making a profit, you would sell it. So, doubt.

They may not be earning profit, but they’re definitely building equity that can be cashed in at retirement. No real reason to doubt the statement.

Sure, you’re certainly their hero

You’re not a bad guy, you just fill a role that perpetuates a bad problem.

Removed by mod

community land trusts, cooperative housing, limited equity housing coops, and municipal housing

Removed by mod

You asked what other options there were, and I provided them.

We don’t need landlords, we can safely eat them and be just OK 👌

Removed by mod

You’re confused: landlords don’t provide housing, contractors do.

Do they pay more in rent than your mortgage payment? Because that would mean that they absolutely could afford it.

If they can go back in time and get the same APR and buy the house for the same price…

deleted by creator

It’s not necessarily about feeling defensive. It’s about trying to stay grounded. I’ve lived in rentals before, but I don’t now, so my experience may not match the experience of renting today. There’s nothing wrong with asking others for input about your own place in society or how you can be better.

You’re not.

Rental income is considered income, and taxed assuming reasonable tax brackets much higher than investment income (That is to say, caiptal-gains. Interest/Dividends are also taxed at the higher income rate)

The cost of maintaining a livable home, property taxes, insurance, property depreciation, and renter interactions eat into the supposed windfall that landlords make.

I’m not saying it doesn’t suck sometimes and that certainly these formulas are out of whack in some situations, but there are no easy answers.

Rental income is considered income, and taxed assuming reasonable tax brackets much higher than investment income

Depends on how the income is structured. You can own shares in a REIT that manages properties and count the dividends paid out as investment income.

The cost of maintaining a livable home, property taxes, insurance, property depreciation, and renter interactions eat into the supposed windfall that landlords make.

We had interest rates as low as 2.8% APY within the last three years. States have been lowering property taxes steadily for the last decade, as prices skyrocketed. Depreciation doesn’t lower the land-value, which is where most of the price inflation has occurred since the first big real estate booms of the 90s. And “renter interactions”? I don’t even know what this is attempting to imply. Is cashing the checks costing you money?

Some of the biggest investments hedge funds have made since the COVID crisis have been in residential real estate. This, in a market where The Magnificent Seven stocks have performed 20-30%/year for several years. Someone who works for Warren Buffet clearly sees a windfall in landlord-ism that you’re not seeing.

(In the US) divedends are taxed as ordinary income. REITs are required to disburse their profits to the shareholders as divedends.

Only buy-low, sell high appreciation is taxed as capital-gains.

I don’t know where you live but in the US the IRS considers rental income as regular income for tax purposes. So when you fill out your taxes it just goes in your bog standard income section.

Additionally all expenses incurred for certain repairs and maintenance are tax deductible. My house gets similar tax breaks as I work from home, so things like plumbing repair (I guess considered an essential service) and regular maintenance can be deducted (although I’ve never gone over the standard deduction so I never really realize those benefits).

In every imaginable way rental income is better financially than “standard” income…though not morally.

FYI, that’s mostly a myth. Taking “home office” deductions has VERY strict rules. Most people working from home don’t qualify and what can be deducted is very limited in scope.

You’re not wrong, even including what was available it still wasn’t anywhere near enough to make itemized deduction a reasonable option. I mentioned the plumbing mostly because I thought it was funny that it was actually included in the list of valid deductible expenses for maintaining a home office.

the IRS considers rental income as regular income…it just goes in your bog standard income section.

In every imaginable way rental income is better financially than “standard” income

?

If I’m reading the post correctly.

One seems to speak to the way the IRS views or categorizes this income and the other is what the financial realities are for this mode of income.

But, I’m not OP so IDK I’m just going off how interpreted the post.

Sorry I meant in the sense that the income is treated the same plus the benefits of additional deductions. You don’t typically get additional deductions or reimbursements for a normal commute job (for instance gas, maintenance, licensing, etc) that you might see for say…well my wife is a good example as a veterinarian. She’s fully reimbursed for CE, licensing, and other items required for her job.

I would argue that a live-in landlord that does maintenance work or acts as a building super is in fact doing a job.

Otherwise, agreed.

Building maintenance can absolutely be a job, which is wholey separate from being a landlord.

I think in this sense it is a little like arguing with petty bourgeois folks who defend capitalism by insisting that they do in fact work. Yeah, you do, but you don’t have to be an owner extracting profit from other people to do that.

My dad did build the house, maintence it and now he collects rent, how is that seperate from being a landlord?

So he was a builder, then he maintained the building. Both of those involve labour and doing things.

Now, if as a landlord he only collects rent and does nothing else, then that’s why it’s not a job, it’s an investment. Same as if you own shares in a company.

If he still maintains the building, then that’s still labour, but the work is the maintenance, not the landlording.

There is no landlording without maintenance, you could outsource it but it’s still a part of it. There’s also a bunch more a landlord has to do, it’s not a full time job but still. You really shouldn’t lump in the average “why build a single family home if i can build a home for two families?” Guy, with those big companies who don’t give a fuck about their tenants.

“why build a single family home if i can build a home for two families?”

Why build enough for myself and my family and be content, when I can extort another family for survival to help me cut costs and provide me a passive income for the rest of time?

Real fucking altruistic… 🙄

Extort lol. Some people want to stay at the same place forever those buy, some want to be flexible and rent. Money is used as an exchange for provided work.

I dislike capitalism and greed aswell but you are something else my dude.

But yeah keep dragging allies in the mud my father is basicly a oil company

Some people want to stay at the same place forever those buy, some want to be flexible and rent

Yeah, that’s bullshit. It’s a MUCH better deal to buy than to rent and everyone knows it. Most of us just don’t have enough money at once or a high enough income to be granted the requisite loans.

In the two decades plus change since I moved from home, I’ve paid as much in rent as someone richer would have paid to own a house several times the size of my apartment in the same neighborhood. I’ve paid as much but I don’t get to own what I paid for and even generate passive wealth that I could pass down to later generations if I had kids.

TL;DR: if you’re renting, you’re getting a bad deal and so is your kids and their kids and their kids and…

People who think they are allies but are actually part of the problem are worse than those who do not pretend. Those who pretend will expect their carve out to be protected.

Proper** landlording is not passive income. It took work, time, and investment into building the structure. Then you have to maintain and repair it. The majority of landlords view it as a get rich quick situation and join the ridiculous market, but if they charge reasonable prices, the mortgage, interest, repair, and maintenance of a home does cost money. And then your own time if you do the repairs yourself or pay someone, the overhead of taxes, insurance, paperwork. Those things cost money. Some of it is paid by paying the mortgage down and creating equity, but some of it has to be built into the rent.

However, some, if not most landlords don’t look at the investment into the equity, they look at the money in their pocket after their mortgage payment, maintenance, and costs every month. They want (sometimes need) their profit now, not in 20 years when they sell it and make millions. That’s why landlording should be viewed as an investment, not a job. It as a side gig works, then in 20 years you cash out.

These giant corporations that have made a ridiculous industry of buying all the homes and property in small towns and charging exorbant prices should be hanged.

So, not defending the land lord here, but, what if his dad built and maintained the buildings for years, but now he’s like 65 and doesn’t really want/or is able to do the work himself so he pays someone else, he is now a piece of shit land lord? I mean, he probably in that scenario doesn’t have a retirement, so the return on his investment (profit after costs) is his retirement. He could sell them, and make a profit, but the next landlord would just up rents so he isn’t eating those costs.

If he jacks up rents to retire fat and happy after his maintenance costs then he’s kinda a dick but if costs stay the same it shouldn’t matter who does what work.

I guess I say all this because I am a landlord of a small complex. I bust ass and do all tge work myself keeping rent lower than anyone else I’m town. We rent to seniors that live on fixed incomes and these people have been our tenants so long they are family. They came to my wedding, they came to our baby shower. I will not price them out of a place to live. But the truth is, I am getting tired. I already work two other jobs and this place needed a lot of work when we bought it so he have remodeled most of them. But I am about done. We have had offers to buy in recent years. A few of them would have made 2 million in profit, but half our tenants would be homeless.

Some of our tenants are widowed elderly women that can’t afford or maintain a whole household on their own. They are legitimately there for the maintenance, not just the place to live.

I have sympathy for your position, it sounds like you’re trying to do the best you can for vulnerable people in a capitalist system.

Under this system the only way you can retire is to have an income unrelated to work. Because we can’t remove ourselves from that system, one day you’ll have a choice to make. It may be worth exploring novel options like transferring ownership to the tenants, having rent increase limits written in to the contract for sale, etc, but the practicality of these are likely very limited.

This is why capitalism is so pervasive, because the best financial decision you can make is the one which furthers exploitation.

There isn’t really a good option tbh.

Landlord and building manager are two different things. A single person can do both, but they are wholly different aspects. He did work as a manager, but not as a landlord.

If you own a company, that’s not a job. If you are also the CEO and bring in half of the work/sales personally, that’s obviously a job. The same person could be both, we all wear many hats, but even if you choose to call yourself the owner over CEO the CEO part is the job, the owner title is not a job

Collecting rent isn’t a job. Maintenance is a job, and building is certainly a job.

If your dad is still doing maintenance, that’s work. If not, I’d say he’s retired, and renting out homes isn’t the problem here

In this context, landlord means someone whose “career” is just owning a bunch of property. Unless your dad is a developer and “built” a bunch of homes by hiring a bunch of people and taking the profits, he doesn’t deserve to be called a landlord, even if the term has been watered down

He rents out a room/house, after literally building it… That doesn’t define him in the same way, he’s not the problem and he shouldn’t be painted with the same brush

Not really, they’re maintaining their asset, just like washing your own clothes isn’t a job you get paid for, keeping your house in working condition isn’t

Washing clothes and building maintenance absolutely is labor.

Rent is far, far higher than the cost of building maintenance though.

Washing the clothes would be a job if you were renting the clothes out.

The problem in my experience is that these landlords cut cost as much as possible, doing the bare minimum to rake in as much as possible. Barely maintaining shit, late maintenance, crappy construction even if it looks nice, nickel and diming left and right. It’s like this at every apt I’ve been at.

Set some limits. Each person can own one primary residence and x number of secondary dwellings. Each additional dwelling is taxed at a higher rate than the one before.

People can still buy themselves a house and maybe another couple houses or condos for their family or investment.

But big landlords can’t profitably buy up neighborhoods then crank up the rent. Or perhaps they can own them, but they’re required to be non-profits and expenses and rents are highly controlled relative to income in the area.

It’s a tough problem to solve though… Huge apartment buildings do have economies of scale that permit high density living.

And property owners who don’t sell or develop their land at all because there’s not enough incentive are a big problem in other parts of the world.

I really like the idea to tax each house successively more. And the money made from these taxes could specifically go to the government buying houses and turning them into social housing, or perhaps providing big discounts for first home buyers.

How about communal housing like in Austria? Not sure what’s the proper name in English.

The trouble is that ratcheting up the tax on additional homes won’t discourage anyone - the additional costs can just be passed on to the renters.

I’d suggest making it illegal for companies to own residential property for longer than 12 months.

Hopefully this would free up enough homes to bring prices back down.

“can be” passed to the renters, but in a free market someone else can do that for cheaper if it is their second home vs their 20th.

Each successive property is less and less profitable the more you have, compared to others that don’t have as many.

But this is exactly the point - the market isn’t free, it’s being controlled. Primarily by companies that are buying up as many properties as they can.

As long ad there are at least two companies in an area, it will be less profitable for every extra property versus your competitor. That at least makes hoarding harder, as anyone can come in to out compete the two duopolies as their first will be way more profitable than the established’s 11th. In turn, keeping prices down, scaled by the increase in taxes per extra property

I’d even settle for a law saying that a single corporation cannot own more than one house, duplex, triplex, apartment building (or whatever) in one city. If you want to have a real estate empire across America, fine. You can have your empire be one building per city.

That wouldn’t work unless you also limited the number of corporations an individual can own. The property owners will just have one property in each company, but they will own like 50 LLCs.

I wouldn’t have a problem limiting that either.

Same, but FrEeEEeeEeEeDoM!

See, things like bodily autonomy and right to exist in general are negotiable, but if you try to limit what one man can own, you’re definitely one of them commies!

Huge apartment buildings can still be done with individual units being owned rather than rented. They already exist - they’re called condominiums.

Folks, there’s a difference between a slumlord and a decent landlord. I’ve owned a house for ten years now, and in addition to the mortgage and taxes and insurance I pay every month for the privelege, I’ve had to spend tens of thousands replacing the roof and doing other regular maintenance tasks. I’m actually about to dump thirty percent of the original purchase price into more deferred repairs and maintenance to get it back to a point where all the finished space is habitable again. Owning a house is expensive in ways that I did not fully understand until I bought mine, and decent property managers are taking care of all that for you, and if that’s not a job I honestly don’t know what is.

Slumlords and corporate landlords can fuck right the hell off, though.

Got a lot of angry landlords in these comments. Oops.

Yeah lot of bootlickers here. Being a landlord means exploiting people’s basic human need for shelter to pad your pockets and taking houses off the market to increase demand.

Fuck that guy up there acting likes hes doing his tenants a favor renting at market rate while he builds 3 houses worth of equity. Parasites every one

Landlords existing isn’t a boring dystopia. Pick a different community for the meme.

Found the landlord

Landlords are pretty dystopic.

My boyfriend and I have discussed moving out of his parents’ house for many years now. We discussed renting, but then I realized it was just cheaper to buy a house in a small town. We wouldn’t even be able to afford to rent in the larger town over that’s closer to his job and a friend of ours told us about how a ghost company bought out her old place, raised the rent another two hundered dollars when they were already struggling to get by, and didn’t even tell people about it until two weeks before the new year. My friends were able to move out when they did only because of rumors floating around.

My mother and I were forced to live in an apartment after we moved when I was a teenager, but the only reason we got in was because the older guy who owned them knew my mom’s dad and used to go hunting with them when they were young. He was kind enough to cut us a deal. That’s literally the ONLY reason we didn’t end up on the streets. Her sibling said we could live at their place until my mother found a job, but about two weeks later kicked us out because “my husband and I have sex every Saturday and we just can’t do that anymore because your son is in the house.”

I knew what sex was, I was old enough to understand, and I told my mom that we could just leave the house for a while every Saturday. It really wasn’t an issue. But no, the person who convinced my mother to move multiple states away from where we used to and convinced my mom that the job market was absolutely booming (it was absolutely NOT) basically told us to fuck off.

Now that we lived in an apartment in the middle of buttfuck nowhere, my mom jobless and sending applications to any place around us to no avail, we were fucking stuck.

The apartment had many issues and the man and woman who helped the older man run the apartment were hillbilly rigging everything that broke so it just broke again. Over and over.

Eventually, and sadly, the owner of the apartments passed away (the guy actually built the apartments himself with the help of his son) and his son wanted nothing with the place. It took a good year for the apartments to sell to someone else. I went to school with her son and she was kind enough to not raise rent, but eventually she sold them off, too.

It was too much work for her husband and herself and her youngest graduated with me, so she sold the apartments to some jackass in Tennessee.

The rent doubled. There was fucking NOTHING we could do about it. The guy who bought them was hours away from us and had his underlings hire cheap labor to start ripping everything apart.

The people who lived in these apartments weren’t rich or had a lot of money. Many were elderly and had nowhere to go, yet they had to leave. My mother was one of them. I helped her move with my boyfriend and we found her a place, but holy fuck, apartments suck. Landlords especially.

Some rich fuck who has no idea what the local economy is like, buys some apartments for cheap, then thinks it is a good investment.

My boyfriend and I are doing our best to currently find a place, but not everyone can buy an entire house to live in. Not everyone has a good enough credit score or people to help them when they are in need.

I’ve seen a few people talk in the comments about how they own apartments and rent them and are “one of the good ones”, and sure, some landlords will work with people. I’ve witnessed it myself, but only out of luck as stated above. The vast majority of landlords are jackasses who only want to line their pockets with money, and even if it isn’t a specific landlord, some scam company can easily buy the apartments and fuck everyone over.

Being a landlord isn’t a job. Taking money from vulnerable people isn’t a job. If you go out of your way to work on the apartments you own, good for you I guess. Congrats. Woo. But you still chose to own apartments or rent out a house. You CHOSE to line your pockets with money from people who are desperate to have shelter, but not everyone has a choice in deciding to rent.

my eventual plan is to buy a decently big chunk of land somewhere out in the middle of fucking nowhere, and then build it into something i’d be happy living in myself.

Hopefully i can still fucking do that when the time comes.

Sorry to say, but the billionaires have already purchased buttfuck Iowa and middle of fucking nowhere in anticipation of there being nowhere else habitable on the planet in the coming years.

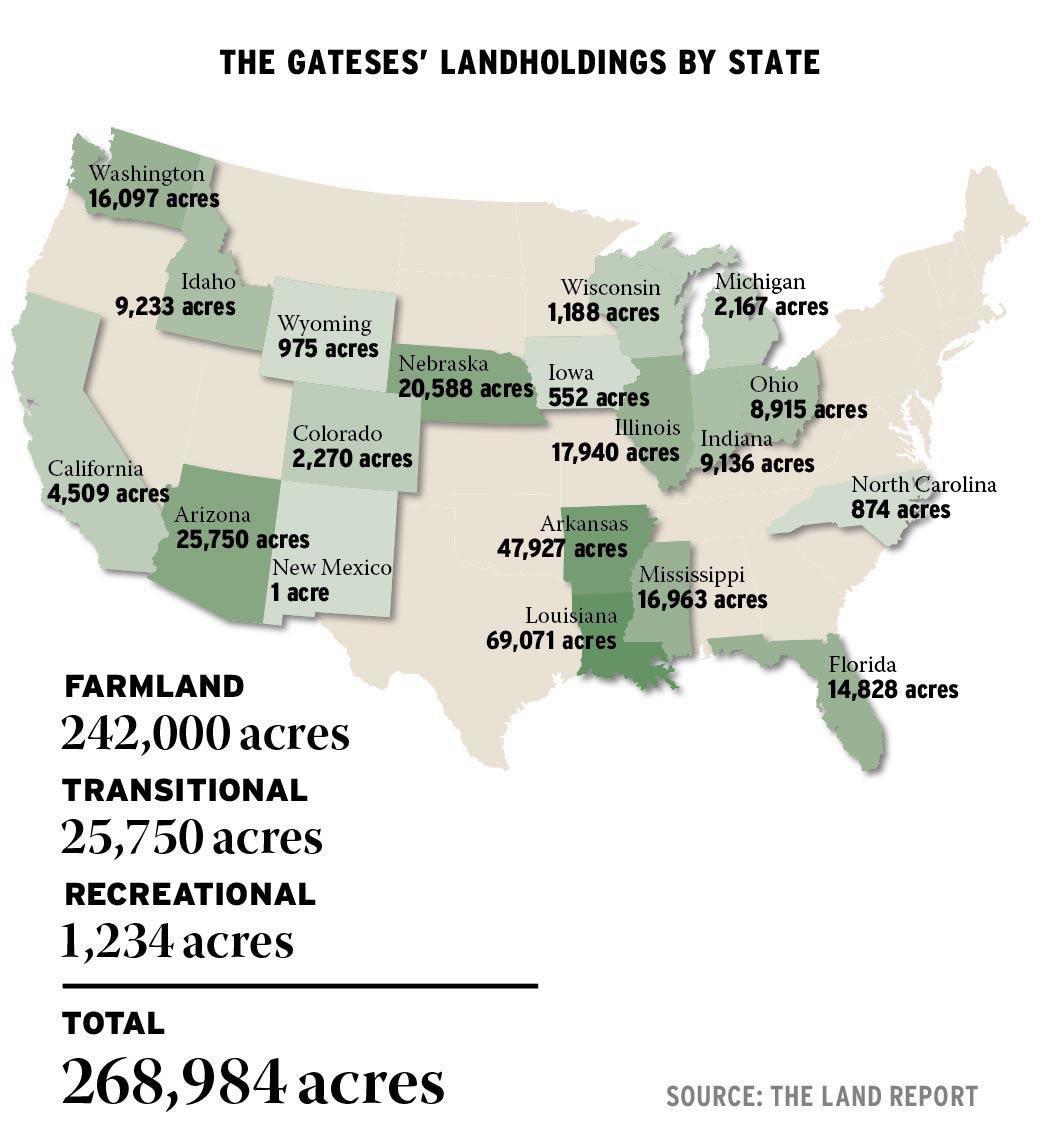

Bill gates owns:

Yeah, nah, this shit should be fucking illegal. Eat the rich.

gotta love the US.

The friends that I mentioned above actually used a decent sized storage shed as their house and built it on family property to save some money. The two of them made it into an actual house with a lot of blood, sweat, and tears. And I mean a lot. Her boyfriend’s family helped pay for some of the supplies and I can’t remember if they ‘only’ owed 60k total on the house or if that included all of the supplies.

I’ve been desperate to move out already but I don’t want to screw my boyfriend and I over. I did find some cheaper land on Zillow that we could have bought, but neither of us have family that could help us buy supplies, and compared to the sizes of small homes where I live, it’s just cheaper to buy.

That’s just my own experience living where I do, though. I really do wish you the best of luck in finding/building a place that you can decorate or even make it uniquely yours. It’s rough out there.

yeah, as for buying land and living on it, the easiest solution to the problem is owning a mobile living space of some kind. That gives you some ground to get off of at the very least.

Unfortunately it’s just a hard problem to solve on account of the whole, not being setup to function in that manner problem. Though if you can find a cheap piece of land with some property already on it, that’s only going to be beneficial i suppose.

look into landships then

landships do sound pretty funny, but i’d much rather have my own campus of actual buildings, ideally one that would be capable of being sold. For the flexibility, but we’ll see.

Housing as an investment should not exist as a concept. Housing is to provide shelter and comfort, not generate wealth.

Removed by mod

Being a good landlord can be a job, depending on the home and the needs of the tenants and whether or not they’re able so whatever work is needed for the place.

The problem is most just want the returns of an investment without the risks of such, and without ever putting any further “investment” into the property after purchase.

I get what you’re saying but it doesn’t really address OP’s point (which I don’t agree with either).

You’re really talking about the maintenance and admin required to provide a property to a tenant. OP is talking about charging “rent” for property, which is a unique type of revenue.

What do you think the rent pays for?

Yes, I’m familiar with the term. But we’re not talking about economic rent, we’re talking about landlording, which only overlaps in the terminology used.

Apartment rents and economic rents are two very different things. Economic rent is extracting value beyond the work needed to maintain the thing, whereas an apartment rent includes payment for the work needed to keep the property in good working order.

In some areas, rent is exorbitant, but I’m many areas it’s quite competitive. I’ve evaluated buying a rental in my area, and the profit margins are too slim for the amount of work needed that I choose to invest my money elsewhere. Many seem content with breaking even for some reason and profiting mostly from property valuations increasing.

Many seem content with breaking even for some reason and profiting mostly from property valuations increasing.

No shit. Equity is valuable. You don’t even need property values to increase. You know eventually you pay off the house, right?

I’m saying even counting that. I’m not talking purely about cash flow, but long term profitability. In looking at properties and local rents, I’m seeing something like a 5-7% growth/year amortized over >10 years after all expected expenses and whatnot, which is quite a bit worse than expected returns in more passive investments like broad market stock index funds.

Granted, I haven’t done the math for a few years so things may have changed, but at least at the time I was looking, a lot of smaller rental real estate investors didn’t seem to understand how to properly value a property and just yolo’d it. It can make sense with higher volume because the cost per door goes down, but I’m talking about small-time investors with like 1-2 properties and no plans to expand.

Personally, if I’m going to buy a rental, I expect to make more than stocks since I’m taking on extra risk and work. The numbers just haven’t looked good in my local area, especially given the higher insurance and borrowing rates for investment properties.

That said, I’m considering it if we move from my house because the lower interest rate makes it attractive (I’m in a sub-4% loan, which should be less than appreciation) and my wife is interested in a part-time job managing a property. Even so, we’d probably still be better off just selling and investing in stocks.

A house is a much safer asset than the S&P. Generally if you have enough wealth you have a mix.

Municipal landlords have by far been the best in my experience. They’re not for-profit, their employees are strongly unionized (though the ones in private companies might be too) and they actually respond to issues you’re having in a timely manner.

You’re talking about city/state supplied housing? I’ve seen good and bad from both but I’m general that seems to be a less and less common thing.

I’m talking about my own experience, which is Sweden. Municipal landlords are not something that’s going away. They’re usually way more fairly priced and a lot of student apartments are rented by them.

Yeah we need more of that here.

Ive lived in a lot of rentals. The ones owned by single owners instead of a company were much worse at doing repair work. Not saying big landlord companies are good, cuz they’re not, but being able to immediately get a repair man is a good thing. I just dont think the average landlord who depends on rent to pay bills are wealthy enough to eat repair costs so easily.

I’ve had the opposite experience. The mom and pop landlord did most of their own maintenance and the guy would take time off work to come fix stuff. Whereas the larger property management companies did everything in their power to not fix stuff.

Yeah, if it’s their full-time job that’s one thing, but if it’s a side hustle they’re passionate about, it can be a very good experience.

It might be the difference of location. I live in the south where there are probably less restrictions and more regulations.

Ive also had bad experiences with landlords doing their own work, for example i had a small fire in a light socket, called 911 and they came and checked and unplugged the light. The flame went out on its own. So the landlord came out theirself and “repaired” it. Two weeks later it happened again. There was a fire Marshall whatever that is there and told us there would be an inspection in a few weeks. The landlords had a company come out that time and they replaced every light fixture in the house.

Like anything else, there’s a ton of variation in quality. Finding a good landlord is just as important as finding a good apartment. Talk to the other tenants before signing anything, look up reviews, etc.

I’ve had pretty good luck, probably because I do my own due diligence. Good landlords exist.

You sound like you blame renters for choosing shitty landlords when there is no way to verify who is or isn’t a good landlord.

There’s a difference between blaming renters and suggesting that renters could do a better job. I outlined specific ways I’ve used to avoid bad landlords: ask tenants and look up online reviews.

Bad landlords should certainly be held accountable by the law. However, that honestly isn’t very practical because your average tenant doesn’t want to be a part of that drama, so they’re more likely to just deal with a bad landlord and vent on social media or whatever.

My whole point here is that good landlords exist and they can be found, it may just take some extra effort on the renter’s part to find them.

So you’re like some paid itern at a housing company. Because you just come off as a shill whos willimg to over look people’s life’s going to shit.

I’ve had both. I’m the end they’re represented by people. Some apartments had good apt-managers and a property company that invested in maintenance. At least one was cheap on maintenance and tried to screw me when I got injured due to such. Their insurance company was surprisingly decent and compensated me reasonably.

I’ve had landlords that were similarly awesome. Usually a basement suite or an old person who rented out to students, and I got lucky with my choice of roomies. I’ve also run across the cheap bastard variety, and some that were downright sinister with some ego thrown on top.

Thing is, the number of good landlords seem to have decreased over time. Most cited a bad tenant experience. Some were older and couldn’t keep up with it. It feels like the “fuck them, they’re probably just out to screw me so I’ll screw them first” mentality is growing on both sides of that fence and I’m the end it’s the decent people who end up screwed they most (on both sides).

Yeah, the idea of rent being required to pay for the property is stupid in general, and should not be allowed, but it seems various financial institutions do calculate that in among the variables for lending.

In the past, I did have a small 2bdrm not too far from a university. After I broke up with my partner at the time, I rented out the room but the non-bedroom areas of the house were common, so it felt more like a roommate situation (we also hung out together, had meals, etc)

Part of the money I got - which wasn’t huge - went into saving, and part of that saving was the “oh shit fund”. A few times, the “oh shit” moment was stuff that broke. down around the place, special levies by the strata, etc.

Anyone who is renting out a full place and not setting aside maintenance/repair money is an idiot or an asshole. Probably both.

Threads like this really stress me out. I live in the US, and I’ve always wanted to rent long-term. I’ve obviously also always wanted a less broken system. If renting was the cheaper option and there were more legal protections for tenants, I think being an independent landlord of a very small number of properties can be well-done. We need to fix a lot before this ever becomes viable, and the stranglehold corps are gaining on the housing market is a fucking crime against humanity. Those fucks are parasites.

I think the real problem isn’t landlording, exactly, but the capitalists we’ve propped up along the way :3

I collect rent from a roommate. The unemployment office doesn’t consider it income so it doesn’t impact my unemployment payout.

The government doesn’t even consider landlord income to be employment income.

Do you own the property? If not, you’re a tenant and it isn’t treated as income because it isn’t income. They’re just paying their part of a shared rent through you.

If you are the owner, they aren’t your roommate, they’re your tenant, and maybe you should get these terms clear before you file your taxes again.

Yes I own the property.

And yes I know that I am taxed on the rent.

None of that is the point of my comment. The rent I collect isn’t treated as income by a wing of the government.

Only because you aren’t reporting it correctly.

I specifically called and asked the unemployment office… I didn’t just guess at this

I’m not an idiot.

It’s entirely possible there’s a loophole or threshold on reportable income in this particular situation, but saying the “government” instead of “unemployment benefits” or whatever is a bit misleading.

The unemployment office is a wing of the government… the department of labor if you need me to be specific

“The government doesn’t even consider landlord income to be employment income.”

But it does, actually, once you start tripping certain thresholds. Which you presumably don’t meet, fortunately or unfortunately for you.

It’d be interesting if you owned a whole apartment building and were collecting unemployment but I don’t think the system’s that broken yet.

What’s potentially interesting about your situation is that if you were to be doing gig economy work for the same pay it might well deduct 1:1 from unemployment benefits, but then the people who read your comment are right back to wondering if your situation is due to the actual law or a misfiling because of a speech error in describing the situation.

And obviously this is all complicated by the fact that US unemployment is usually enacted on a state level, so one state government might allow this and another might not.

I looked into gig work to supplement my unemployment and it deducts 75:1 in my state. It’s definitely not worth all the extra work to potentially get another $250 so I’m not doing it. Gig work is my fallback if I can’t find work before the insurance payments run out in June.

In my state, your tenant would not be able to claim renter’s credit on their state income taxes because its all being done off the books.

It’s not being done off the books? We have a lease agreement and it’s all above board.

Yall are wildin with your assumptions

Off the books means you aren’t reporting it.

I’m reporting it on my taxes.

I called the unemployment office to specifically ask about how rent impacts the insurance payout, and they were explicit that it doesn’t.

It is above board

Removed by mod

Because I let someone who was going to otherwise be homeless rent a room for well below market? Damn

deleted by creator

The only thing they’re really doing wrong is gaslighting people by calling them a “roommate.”

Otherwise it’s just people surviving under capitalism. OP didn’t capture the rental market, that was done by much, much bigger fish.

He’s beating the game

Not really… They’re just being nicer to a friend than another landlord would be. It’s not like the friend is buying equity in their house.

This makes OP a better landlord than most. It also demonstrates how the system is rigged to benefit property owners over others.

You’d have to get rid of the concept of private property and that isn’t going anywhere. Same with landlords.

You’re not going to vote this out of the system.

You don’t need to get rid of private property to undo a lot of the damage done by landlords. You can build subsidized housing to compete. You can write tax codes to make it unprofitable for people to own more than one house. You can tax land by area instead of by built value to encourage building high-density housing.

There are a lot of levers that other countries have been willing to pull that partially counteract the damage of landlording, but the US has been reluctant to touch.

This is the only comment that I read so far that goes a bit deeper than: landlord bad let’s remove them

Thank you

I especially like the “lever” analogy, most people tend to think in absolutes and dichotomies, instead of realizing that an equation can have many variables with many coefficients.

That’s the same argument people made when we abolished slavery. “But if you do that property as a concept will vanish”. No. No it won’t.

Did people vote slavery out?

In the USA that’s a complicated topic. If you look at how it played out in England and France, yes. Slave owners were compensated for their “losses” after heated debates in parliaments

It’s still in, baby

I don’t get it… if someone works and invests in a property, they pay a significant amount of money to have and maintain that property. If someone can only afford to rent for a short term period of time, what then? Is the next step that the person spending hundreds of thousands of dollars on a house supposed to just hand it over without selling it to a tenant? What is the alternative?

Put a limit on how many single family homes anyone can own. Especially corporations. They should honestly be banned from owning these homes at all. The housing market will adjust naturally without all these shitty big companies scooping up homes and making them inaccessible to buyers.

Individuals should also be limited on how many homes they can own if anything to prevent corporations from exploiting loopholes and having individual people “own” them instead. But also because it’s just morally wrong to hoard property in the first place. I pay more in rent than I would on a mortgage but I can’t afford the down payment for the very few homes that are even available within a reasonable distance from my job. Even if I could so many companies smatch them up over the asking price so people don’t have a chance.

People like me that could financially afford the payments on their own homes are blocked by bullshit that was created solely to keep them perpetually renting. It’s wrong. I shouldn’t have to move to a whole new state or two hours away from my job because the same big company has bought up every house here. Not to mention a bunch of them recently got busted for illegally controlling the rent prices across multiple companies/properties using some kind of third party algorithm.

I don’t think anyone should have to give up their property for free but if we’re paying someone else’s mortgage we should be getting more than a roof over our head.

As someone who was brokering mortgages during the housing boom this is exactly what happened. Landlords were usually just 1 or 2 extra properties, the odd person owned an apartment block, but it was all in personal names.

Once the corporations game started is when prices went nuts and havent stopped. Stop the corporations from owning rentals and this will all be solved. Personal liability is about 20 properties as far as the banks are willing to lend someone, corporations are unlimited if the numbers check out , which when you control and manipulate pricing, it always will.

If you limited house (single family residence) ownership to something like individuals, sole proprietorship, or partnerships, it would also remove liability protections which come with corporate structure, so it might make owning a large number of properties less attractive. That would be a good thing. But what would really drive housing prices down would be if houses were a public good.

HOUSES SHOULD NOT BE INVESTMENTS. They are an essential need and we have many people with no homes.

The alternative is stop treating them like investments. An owner should live in the house for some reasonable portion of the year. Crucially, this means corporations wouldn’t be able to purchase homes. If you do that, housing prices would stabilize to much more reasonable, attainable levels.

If people weren’t allowed to own property in absentia, then real estate prices would stabilise at a much lower level. As it is, this arrangement allows speculation which creates an unlimited market size. Some of the highest priced real estate in the world sits entirely empty for exactly this reason.

Without that the only people trying to buy housing would be residents, and at the point where everybody would be housed, housing prices would presumably be extremely low.

As for temporary, emergency or other unusual housing arrangements, non-profit organisations or cooperative systems could exist, and without property prices to protect everyone could be housed.

And because someone will always bring this up: going on holiday doesn’t mean you’re not using your house. Most of your shit is still in there. That’s a facile argument that vanishes the moment you give it even the most cursory critical thought.

That said, this entire thing is unlikely to change in a world where the wealthy decide our policy. Landlording will probably be with us until we can find a way to abolish the market form entirely.

This is just childish mimicry of Marxism. The “landlord” as a source of income becomes a villain because the landlords as a class were villains in the eyes of Marx.

That said, people who full-on hate all landlords would say “fuck you and your money you filthy capitalist pigs” to your argument. That the house is hundreds of thousands of dollars doesn’t mean much to a communist because “property is theft”. Yada yada.

That said, the fact of that seems to bury the real criticisms about megacorporate landlords that represent a fairly large percent of all rental properties.

It is an investment, not a job. All investments generally exploit others (by “stealing” surplus value). Stuff like maintenance and even management of properties are jobs, but they don’t require ownership of the property (in which case, some of the value of their labor is being stolen, assuming the landlord is making a profit/building equity in excess of rent).

Alternatives could be public housing, some type of housing cooperatives where tenants build equity which can be redeemed when they move, and probably many other systems I am unaware of.

most of my investments dont require me to fix a sink. or find someone to repair a leak that sprung in my cds.

“Stuff like maintenance and even management of properties are jobs, but they don’t require ownership of the property.” You can hire a person or company to take care of everything; there’s a whole industry around it.

yea sure i suppose if we move the goal posts it does fit.

From what I have seen, having a property is a lot like having a physical body. It must be groomed, fed, watered, tended to, mended, etc. It ages, parts wear down, it starts to make creaking noises. And what’s more, you have a limited time with that body. Eventually it dies. As to your question, it’s getting to the point where the only thing capable of taking care of a property is a corporation, and unlike people, corporations don’t die.

Be a landlord

Pay a cleaning crew to handle the janitorial services.

Pay a contractor to handle repairs.

Pay a management company to handle the day-to-day activities.

Complain that I’m not making enough money on the property.

Raise the rent to the market-clearing price.

Demand the municipal government lower my taxes, because its the only way to incentivize me to buy more property.

be landlord

30% of my business expenses are shit i don’t need

why is my business not making money???