Eleven years ago, two days before Christmas, my 24-year-old brother, who was a university graduate and former law student, died from a self-inflicted gunshot wound. After a decade of hard and continuous drinking interspersed with addiction and mental health treatment, he could not sustain his recovery. His suicide came on the heels of my mother’s death a year before, and just weeks later, my grandfather died in a car accident. My family’s holidays would never be the same.

Like so many others who survived the loss of someone dear from the chaos of severe substance use disorder (SUD), I am too familiar with unspeakable grief. But I have found meaning through it and purpose in passing that on.

I was a medical resident when I dropped my brother off at an addiction treatment facility for the first time. Later, I became an addiction specialist physician, focusing on treating people with SUD and helping them manage their disease and find remission and recovery. My work has taught me something important: To help stop the addiction crisis that has brought so much sorrow to families like mine, policymakers must prioritize prevention at all levels and support evidence-based prevention initiatives — including raising federal excise taxes on alcohol.

“My brother killed himself after self-medicating with alcohol for a decade in order to cope with horrific systemic social ills. So instead of fixing those, we need to make it harder to self-medicate. He probably would have just killed himself sooner. But at least he wouldn’t have been a drunk for 10 years!”

deleted by creator

Drug availability makes the likehood of addiction to a particular drug even more likely. We saw what happened when pain killers were prescribed willy nilly, it’s lead to many more people ended up with crippling addictions. Ultimately, I think your point is a good one but raising taxes might be part of a wider strategy for lowering use.

Painkillers were prescribed and promoted as safe and not addicting, which was a complete lie. Low cost was not the reason for abuse.

Cost directly effects cigarettes use. That’s why public health says to tax it.

A shitty strategy. It just means people pay more, not drink less.

Once you’re caught in the loop of self-destructive behavior, increasing the cost is not likely to help but at least you’re presumably paying for related services. The scenario it makes the biggest difference in is when someone is deciding whether to go down that path. Some will just turn away

That’s not 100%. There is truth to it.

Why not both? Increasing the cost of a substance being abused is a good first step that will help some people. Using that money for care is a good second step, self-funded. Then the hard part is better safety nets and addressing reasons for despair

Ah yes, Prohibition for the poor.

Taxes reduce consumption? Id Image people would give up other things before their alcohol, and they’d switch to cheaper alcohol before resorting to reducing.

Gonna to skim the article now

Edit: seems there actually is decent evidence that increasing taxes by 6% caused a 4.7% decrease in [violent] crimes. Or something there about, I skimmed like 3 papers

deleted by creator

Let’s not compare the average American to the average European please.

deleted by creator

The thing is, whether you attribute it to value or not, the average European isn’t the same as the average American. What works for the goose may not work for the gander, to paraphrase a trope.

I thought in that saying that gander was a group of geese

I’m not European, i’m South American (Chile 🇨🇱).

But that does not impede me from appreciating how society works in the “old continent”.

deleted by creator

Carbon tax, baby. Canada does it.

Just want to say, props for actually looking at evidence that would challenge your initial viewpoint and changing your views in response to new information. Not enough people do that.

Been sober for years now. No way this works.

Yep, treating symptoms instead of causes always works.

I’ll echo other comments here that simply raising taxes does not seem like a successful long-term intervention strategy in a vacuum—and I don’t think the author intended for it to come across this way, though it kind of did. The availability of mental health services and a number of societal ills are what need to be addressed.

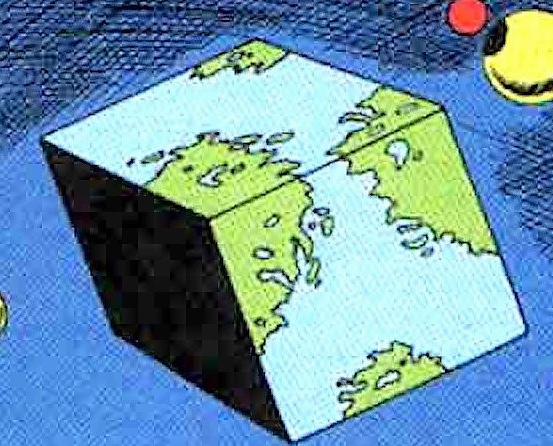

I’ll also add that in the same period when the author discusses a decrease in alcohol-related injury deaths, post-1991, there was an increase in illicit drug use as illustrated in this National Institute on Drug Abuse chart. While the increased trend in the use of any illicit drug is largely driven by marijuana in this chart, you can see there are also moderate increases for other drugs like LSD, cocaine, and later heroin.

Did the sudden availability of certain other drugs plus the higher cost barriers to obtaining alcohol create an environment that led to more drug abuse and other drug-related deaths? I don’t know, I’m not a researcher, but it’s a question.

Raise the taxes to lower consumption? That’s just stupid. I’m Polish. They tried this here. Beer is around 30 percent more expensive than last year. Vodka around 25. It didn’t made me buy less. I have to buy in bulk, what makes me drink even more. Or buy cheaper, lower quality alcohol. Or save money on other things.

This is called a Pigouvian Tax, and they definitely work.

https://movendi.ngo/news/2022/06/07/alcohol-tax-increase-in-poland-leads-to-falling-alcohol-sales/

I strongly disagree with this opinion piece and find the writer’s intentions heavily biased, at best, but Pigouvian taxes as a concept are definitely effective.

Thanks! Wasn’t the Tobacco settlement fund used to promote anti-smoking programs, given to communities for anti-smoking ordinances, and enriching other public health initiatives that helped make it so effective?

There has to be a use of the tax effectively to discourage the next generations and help increase treatment otherwise the taxes alone could hit a level where some states might start to ignore regulation & the moonshine stills fire back up.

I feel like making things more expensive doesn’t address the root issue.

Maybe things like healthcare, food and housing should be cheaper and more available instead.

Alcohol is poison, it should be taxed more just like tobacco

Here’s a thought, making “sins” more expensive just makes poor people live in greater poverty to keep their sins a part of their life, making them more miserable and increasing their reliance on said sins.

Increasing luxury taxes on sin items only serves to make people feel like they’re doing good while getting their ticks off on punishing bad people.

Focusing on the poverty issue will do more to prevent unnecessary deaths to drugs and alcohol than making them so expensive only the rich can afford them and make the world a truly better place for everyone.

deleted by creator

Removed by mod

Yeah, this will end well.

Our “society” sucks. Much of the country lives in subsistence to a few rich assholes.

Clearly the owners won’t permit that reality to change, but if you want riots and more mass shootings, by all means, take away your capital battery’s means to cope with it, too.