However, the upheaval millennials and Gen Z have faced may soon be behind them. The former is expected to become the “richest generation in history,” courtesy of a $90 trillion great wealth transfer in the coming decades, while younger consumers generally say they’re feeling more optimistic about their financial futures.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

$90 trillion great wealth transfer. As if that money is going into the hands of people who aren’t already obscenely wealthy to begin with.

Also the the boomers with any wealth are going to live a lot longer. My boomer mom’s mom was 91 when she died, the only reason my mom is solvent is because she inherited and sold grandma’s house.

If my mom lives that long I’ll be in my mid 60s and my brother in his 50s. I’m a late Gen Xer btw.

So the timeline is at least 15-20 more years.

Subscription services will be like “sorry it’s $1k per extra seat now”

This is what neoliberalism and capitalism wants the younger generations to believe, but a large percentage of that wealth will be stolen via health care and similar predatory, exploitative systems.

And do you think the inflation caused solely by greed might be related? They need to capture that money now before it is inherited.

Reverse mortgage enters the chat.

This. My grandparents were well off and set up a trust for me and my brother.

It wasn’t much. And then all of it went into her nursing home when the dementia got so bad we couldn’t care for her ourselves anymore.

And the rich got richer

Yeah, nah.

That wealth isn’t fairly distributed. The children of rich parents will be richer, the rest of us will be worse off.

Whatever isn’t sold off for long term care, which won’t be much.

… $90 trillion great wealth transfer in the coming decades …

This only counts if your deceased parents have any wealth to transfer.

Trickle down economics in a trenchcoat.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

Only if you don’t have to sell the house beforehand in order to be able to afford a nursing home for your parents

deleted by creator

deleted by creator

deleted by creator

deleted by creator

Dave Ramsey sounds like someone who has forgotten what happened last time.

I’ve been sick of him from the first moment I met an adherent. I mentioned how I like to avoid debt and pay it down early and the person said “Oh, so you listen to Dave Ramsey?” I confessed to having no idea who they were talking about, and they swore that I was being obtuse because I couldn’t have come up with “interest sucks” on my own.

Those who are undereducated often can’t imagine that people can be truly brilliant.

Interest bad is far below brilliant

I guess we could be grading on a curve of people that view Ramsey as brilliant…

George Washington bemoaned debt

No just interest, compound interest is bad

Add in another for trickle down, and the various forms the owner class use to divide us

Thanks, I was gonna post this if someone hadn’t.

We should teach the millionaires to fear again

I’ve always made good money, and got some good advice when I started my first job to just always put aside 10% for saving, and put that into ira/401k. I’m in my 40s now and a millionaire. I still have to work and will until retirement age.

I know I’m lucky, but you’re really barking up the wrong tree if you think simply having a million dollars makes you bad person. I’m just a saver.

These days, I don’t bat an eye at a seven figure or even low-mid eight figure millionaire. That level of wealth is attainable through individual means (hard work, saving, diligent investing, etc) and probably a significant amount of luck. It’s once you start getting into the mid to upper 8-9 figure and then billionaires where there is no way they achieved that wealth without exploitation and all the other accompanying things these people perpetrate.

Low 8 figures is my in laws. They are both doctors and busted their butts throughout their career. They could have done better had they invested better, but they still have obviously done well for themselves.

Ok then let’s teach the billionaires to fear again.

Too high. How about 100 million?

Done

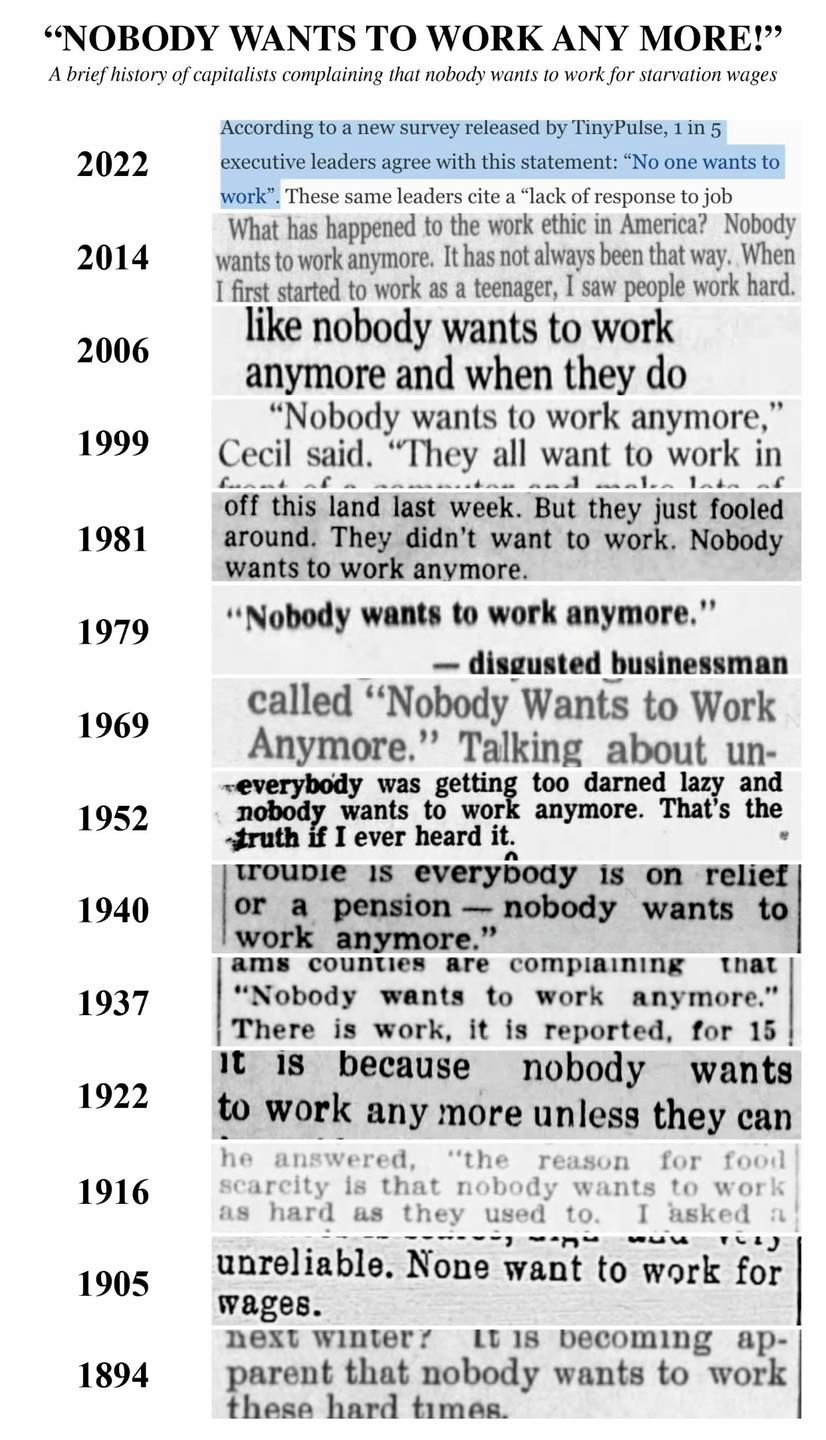

It’s not that they don’t work, it’s that their employers (boomers own the companies) don’t want to pay them

He knows this. I used to listen to his show. And in all my time listening to him, he never took on a caller who was making nine bucks an hour and struggling to make ends meet. His most frequent type of caller is a straight late twenties couple who make $140k a year, who owe maybe $25k in credit cards, and whose obvious answer to fixing the problem is to sell the thousand dollar car payment for something more basic and eat out less often. Because he knows if minimum wage workers get past the screeners, there’s nothing he can do to help. That’s a systemic problem and he knows he’s part of it. What’s he gonna tell them? Go get a better job? Cool. If everyone does that, there won’t be any of those jobs for 90% of them, one, and two, there won’t be anyone working those important low wage jobs. Someone’s gotta flip the burgers. Someone’s gotta stock the shelves. The problem is systemic. And the answer is fuck the rich.

It’s not that I’ve been dealt a losing hand, it’s that my generation wasn’t dealt a hand at all, and were cussed out when we asked why the dealer left us out… Then they told us we lost the game because we were too lazy to buy our own cards to use, even though that’s not how Poker works.

I lost all respect for Ramsey when I came across a video of him saying he wouldn’t take a 0% interest million dollar loan. His opinions on finance are outrageous and dumb.

His whole thing is being anti-debt which is probably good for some people, but some people already have no debt

Yea. I have managed to never carried debt. Without that, what’s this guy got to offer me? In fact, the only thing the guy has to offer is the simplest financial advice there is: spend less than you earn.

But then a poor person comes along and says they can’t and his only advice is ‘earn more money’. Because it’s that easy, obv.

The guy is an out of touch chode who had some privileged upper middle class kid think he was the financial messiah once for saying ‘use a budget’ and let that go to his head.

For some people “use a budget” is revolutionary advice. Most people don’t literally track every dollar they spend, although apps and software make it much easier now.

Some middle class and wealthy people make a decent amount of money but spend it all on leasing a few luxury cars and going on vacation. These are the people who “budgeting” works for.

They literally cut back on eating out and save $500 - $1000 per month (“cut back”, not eliminate). They end a lease and save an extra $1000. They use this money to pay off their $50K credit card debt and it’s eliminated in less than 3 years.

Exactly. That’s who his advice is for, but he markets himself as a guru to the poor and they gobble his bullshit right up and spend all their money on his financial peace university that’s just a book full of anecdotes of wealthy people learning how to do what the poors have been forced to do all along.

True. Most poor people are pretty good at managing money because they are forced to. They just don’t have any money to manage.

Thing is, this advice is useless to anyone who straight up has no money and the rich legitimately don’t understand that situation.

Not having debt would have been nice, but it’s kind hard when your parents shove you out the door at 17. I worked full time through college, shared an apartment with three other people, and ended up 50k to get a degree in a field that I can no longer work in (my state is currently covering up the murder of a transgender child, and as a fat hairy bearded man, I am legally required to piss in a stall next to teenage girls).

His advice works if you’re an upper middle class person with a supportive family. You can’t budget if you are making 12k a year.

my state is currently covering up the murder of a transgender child

What?

Nex.

Ah. It’s sad I had to ask for clarification as to which one.

I’m pragmatic to a fault and so his advice often makes me cringe.

However, I still have respect for him.

First and foremost because he was the gateway for my wife actually caring about our finances. And so her realizing that we can make a lot more money in the long run by not recklessly spending it now I have to credit him for…I couldn’t get through to her, but now she comes to me for most all financial advice.

However it’s also because for a lot of people their relationship with money is more emotional than it is rational, and for them he is very good. Watching my wife go through the transformation gave me an appreciation for what he preaches, even if it isn’t logically the best path, it’s often the best path for a lot of people.

I’m a gen x, and I don’t want to work. I mean really, who does? Who would rather work than spend time with their family and/or see the world? I work because I have to to survive.

People want to work if:

- it is meaningful to them

- their work is a mean to do something meaningful to them.

If you work to survive, there is no prospect to advance or do something fun/meaningful, then why the fuck should people want to work?

And Ramsey is kidding himself, is work is not that hard. So it’s fucking rich coming from someone that peddle his shit to make money.

“want to work”? that’s only for actual humans, you are a parasite leaching off the work of the people who are actually productive, the shareholders, and if they all go hide in a secret valley gated community the world will collapse as they invent a perpetomobile outside the “laws of nature” imposed by the government

(everything up to the perpetomobile is actually held beliefs among these people, just the laws of nature being enforced by the government is a bit of a gag)

What is so bad about living with your parents? That’s still the norm in many parts of the world. For some reason western countries, and especially America, have exaggerated the benefits of being financially independent, as if shared resources were some kind of failure.

I beg to differ. The only people who lose when we share resources are the capitalists.

I’ve got a few friends in their thirties who live with their parents and the whole family is very happy. And although my kids are only six and three, I can’t imagine any reason why I wouldn’t want them to continue living in my house for as long as they needed support.

We all need support. It’s not a shame. It’s an asset more valuable than property, imho.

you might be gay and have to move out, assuming they didn’t throw you out as a teen. even if you’re straight your parent’s won’t respect you as an adult if you live with them and impose restrictions on your lifestyle. you also have to appease them in whatever crazy shit they force on you because they can kuck you out if you refuse

Did that happen to you?

deleted by creator

The second job thing is interesting, it’s like he doesn’t understand that the economic situation of a society as a whole (generally a country) dictates what % of people can afford to have nice things.

As a result of that, if your society is in a bad economic situation it may very well be the case that even if everybody was working the same number of multiple jobs, advocating for themselves, and busting their butts, most of those people are still going to be in a shitty situation due to things entirely out of their control. Furthermore, the ones that got out of the shitty situation, even though they’re doing all of the same things, only did it due to dumb luck / being in the right place at the right time.

His “no debt” spiel is a decade out of date. The red queen paradox applies here, most people need to run as fast as they can, just to stay in the same place.

The average house here has gone up in value 55 euros a day for the past decade, and rent has risen faster Unless you’re already doing very well, you cant budget your way into buying a house anymore. Saving 55 euros a day for a decade means you’re standing still, you need to MORE to actually get closer to buying property.

Again, that’s 55 bucks a DAY, or 1650 a month, just keep pace. Dave Ramsey can fuck right off when it takes 32 hours at minimum just to stay as poor as you always were.

No debt has worked for me. I don’t care for him and any of his advice, but getting out of debt has been great for me.

Going by your comments, you’re hardly a struggling gen-z though. When you or I run in place, we’re already miles ahead of those who can barely get off the starting line.

But you were in debt, and the example given of a home mortgage is pretty definitively a debt worth taking on, as rent and increasing housing costs will easily outpace accrued interest.

You should pay that debt down quickly, unless you’re mortgage rate is crazy good and investment returns are crazy high, but that’s not usual. But taking on a mortgage is about the only way you can get into owning a house except for being a trust fund baby.

Some people may have to suck it up and tolerate a car payment, of they can’t afford a 6 to 9 thousands dollar car, because they need transportation to get to work, and any car cheaper than that will be very expensive to repair.

Carrying over any balance on a credit card? Yeah, that’s always a terrible idea.

His no debt spiel is really only get a mortgage once you have no other debt.

Removed by mod

I like to imagine this means “fixed that for thee.”

Dave “I fire people that have sex out of wedlock” Ramsey? Who cares what that religious nut have to say?

“fiance guru” isn’t a real job. Fight me.

They’re a joke, they literally produce nothing. O I made one number bigger. Congrats you’re a counter.

Finance guru vs. Jiu-jitsu guru…

Eat the rich.

I’m fine with just throwing them in a wood chipper, personally.

Feet first, of course.

We could study the psychological effects of watching one’s limbs being fed into a wood chipper.

Y’know…for science.

Would be ok with that too!

With some fava beans and a nice Chianti.