Some 7% of Reddit’s free share float (or more) has been sold short so far, according to an estimate from the analytics company Ortex cited by Reuters. That’s something the social platform was worried would happen, noting in its prospectus that retail traders in its subreddits (and particularly on r/WallStreetBets) could cause “extreme volatility” in Reddit’s share price. Those Redditors had already signaled in posts that they were planning to short the stock.

Public data revealing short interest positions on Reddit won’t be available until April 9.

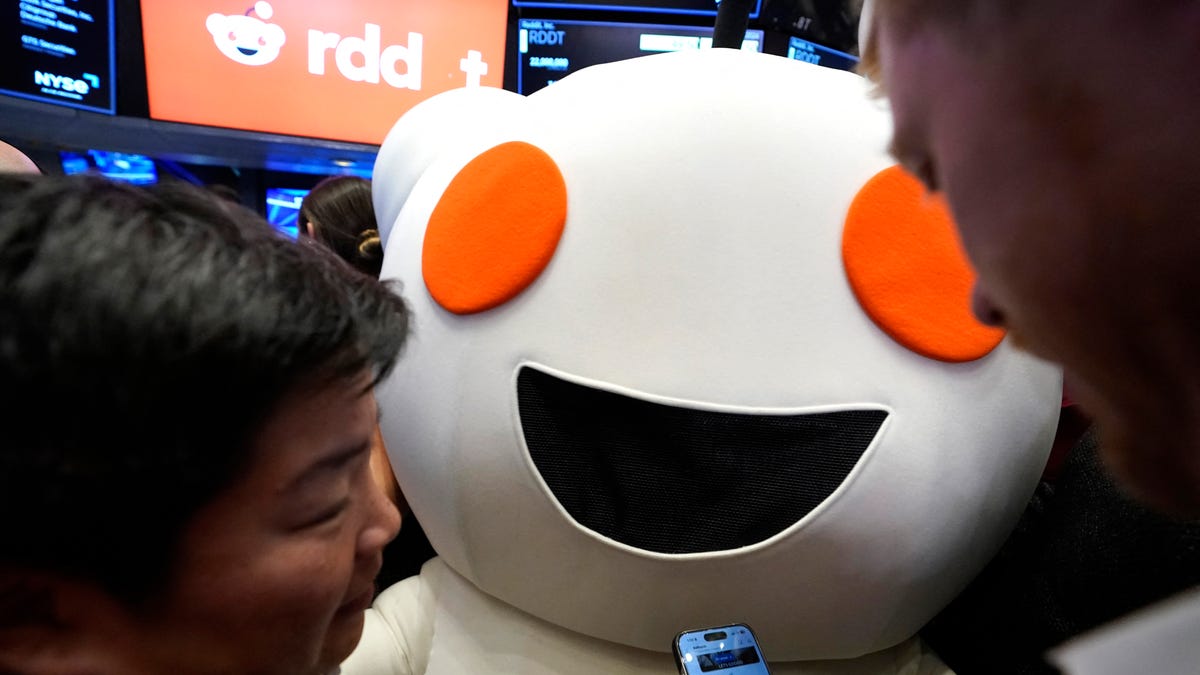

Reddit shares fell as much as 11% at market open to a low of $51.52 after an already-bad Wednesday. Bloomberg reports that Wednesday’s decline was in part due to a Hedgeye Risk Management report naming Reddit as a short idea, saying the stock could plummet 50%.

Reddit’s share price in the low $50 range is still well above its IPO price of $34, and even above its impressive first-day closing price of $48, which had investors chattering about the company’s impressive gains.

Can we trust that posts made to reddit to purposefully influence reddit stock are legitimate posts and not manufactured by the admins in some way?

No, nor can we rule out that they’re not attempts at influence by external actors, either.

I think the best course of action is to just not touch the fucking thing – the stock, or the site.