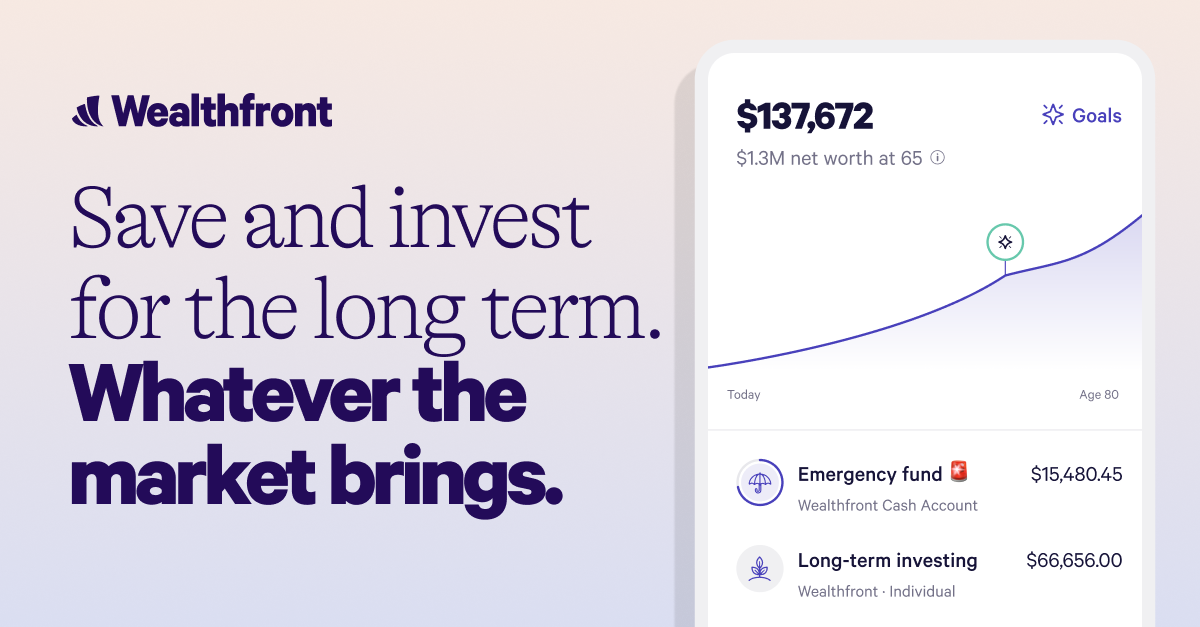

A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates.

Growing up in a world where savings accounts and even CDs never approached more than 2%, the rates on this new thing blew me away.

Free money is great, and I’d love to take advantage of these rates, but the only cash I have currently is the emergency fund I’m trying to build.

Anyone have thoughts on if putting an efund in this kind of service is a bad idea? Not sure if it’ll be liquid enough if a major expense comes up.

I have my savings in a high yield savings account (FDIC insured) and a checking account at the same bank, so I can access the money pretty much instantly if needed. I don’t use Wealthfront specifically but I’ve heard good things about them. Once you earn more than $10 in interest you do have to pay taxes on it.