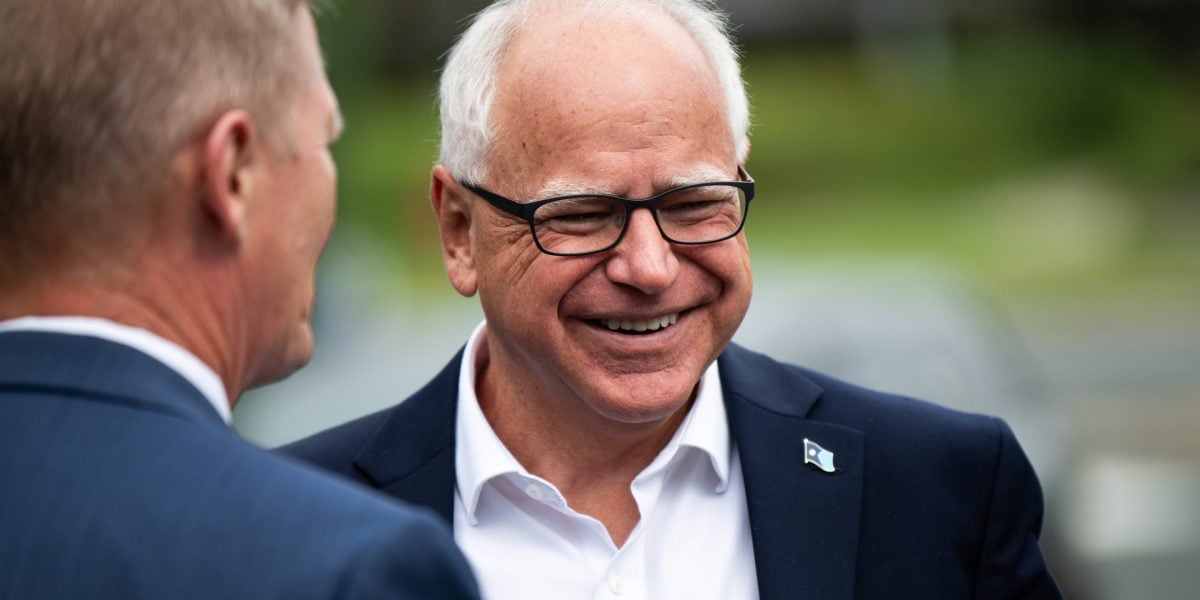

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

I’m sorry, 1 in 15 Americans is a millionaire?? Holy shit.

Regional cost of living, and the inflation around it, really skews those numbers. A million in San Francisco or Manhattan is very different than a million in the middle of the country. Housing and pay are a lot higher in the major metros.

I’d love to see what these numbers look like when adjusted for CoL.

1:15 has a net worth of a million. That includes all possessions, pensions, etc.

Treasure a retiree with a house that’s worth a couple hundred grand, throw in their 401k, vehicles, etc and it adds up.

Look at it this way: my car is probably worth about 20 grand, but that doesn’t mean I have that much cash. Ask me to cough up an unexpected $500 and it’s gonna hurt.

At that age yes. It’s the only way a relatively high earner can maintain a similar income out of retirement and they also tend to own their homes.

Oddly enough very easy to accomplish with property and retirement accounts. Doesn’t apply (and probably won’t apply) to most genx, millennials or gen z, as Boomers shit the pool.

My father is quite proud that as he nears retirement, he’s scrounged and saved enough to break into the millionaire’s club! He also voted Republican for his entire life, and now I probably won’t ever be able to retire, so thanks a lot dad! (This is also one of many reasons they aren’t ever getting grandkids.)

Yup! And they wonder why younger people aren’t having kids. Lol

Only if you include their retirement savings that has to cover their aging healthcare costs. If you are earning a pension in your country and have free healthcare then you can’t directly compare American salaries and networth.

It gets further muddled when you factor in how shitty American cities have become. Americans have chosen to have higher wages and endless urban sprawl rather than build public transit and make their cities great places to live.

Yup. And that’s for all age groups. According to this link, 28% of 60-64 year olds are millionaires.