- cross-posted to:

- economics@lemmy.world

- cross-posted to:

- economics@lemmy.world

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

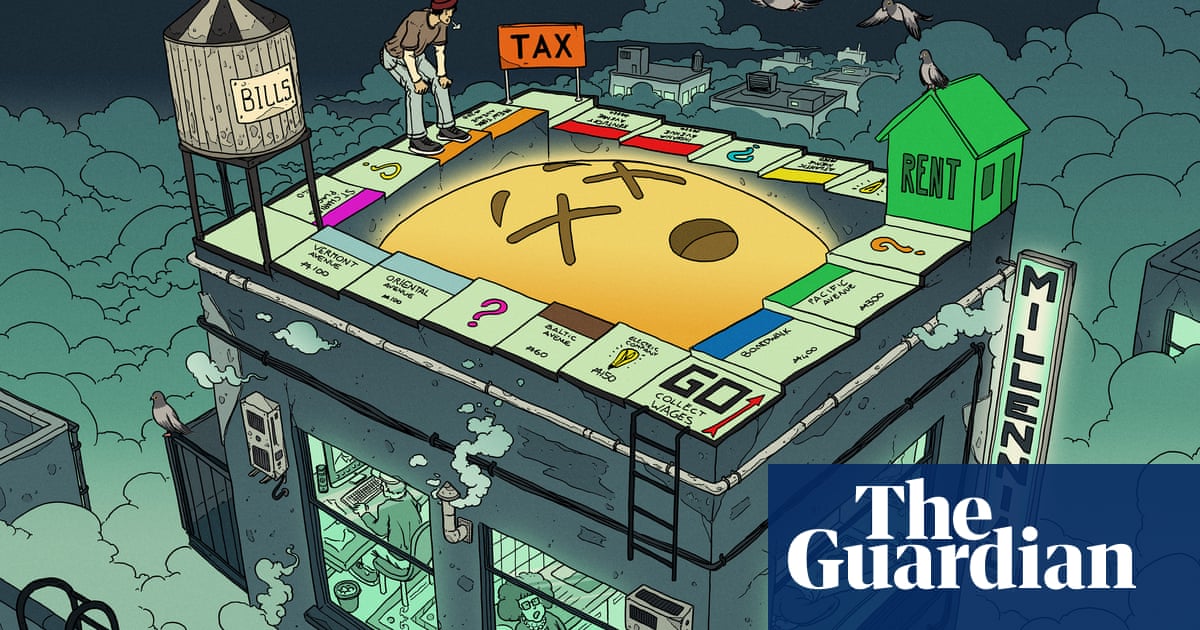

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Gonna leave a bit of advice for any young folks that might see this. Something I wish to god someone had told me when I was 20.

Start an annuity plan. They’re generally stable, all but guaranteed to accrue money. You can set a percentage of your paycheck to be deposited automatically into the account. If you have the option to do this through your employer, do it, find out if they match the deposit like mine. Put 10% of your paycheck in there. After 10 years, I have $40,000 sitting in a retirement account with a progressive series of bonds set to mature in between now and my retirement age. Those bonds will roll back into shorter term bonds as they mature, and add more value to the account. My projected retirement age is still 72, but at least I know that money is there.

Also, after 4 years, the account matures and you’re able to borrow against it, like collateral for a loan. So if I wanted to right now, I could take that money and use it as a down payment on a house. I’ll be expected to put it back, but the interest is generally lower than a home owner’s loan.

This sounds a lot like superannuation that we have in Australia and is mandatory. A certain amount of money from your paycheck is put with a super and they invest it for you, and the idea is that you should have a few hundred grand by the time you retire.

In the US that was Social Security but currently it’s broken