- cross-posted to:

- economics@lemmy.world

- cross-posted to:

- economics@lemmy.world

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

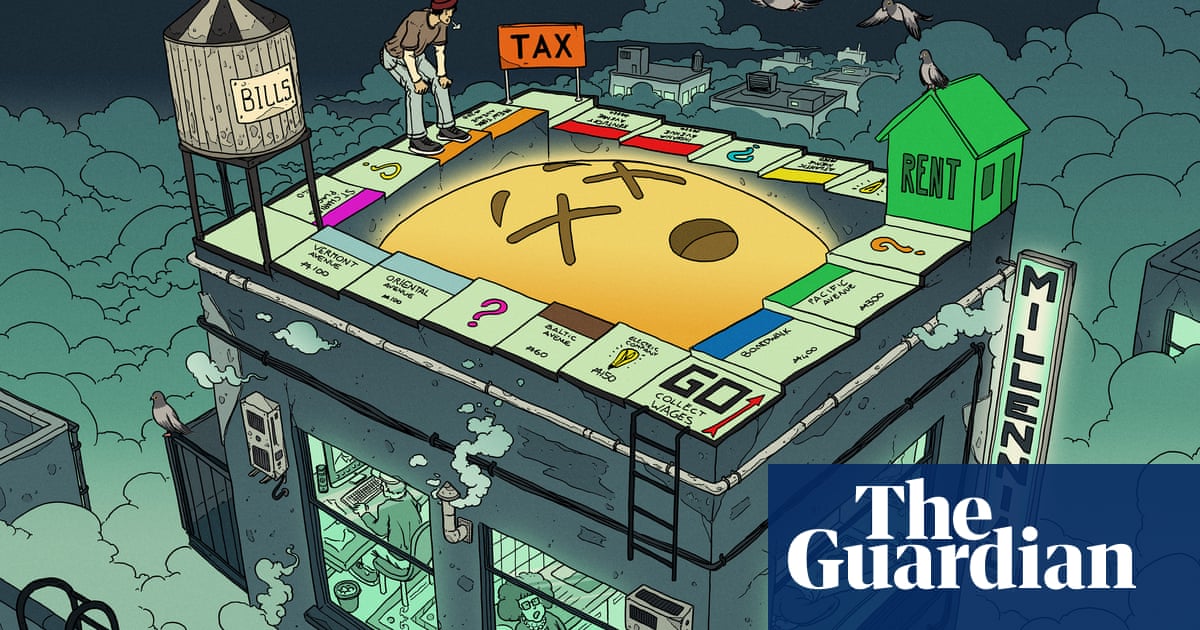

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

You only need like 5% down for a home. Zero if you are a veteran for some reason. Mortgage is almost always cheaper than renting.

Unfortunately, this age-old folk wisdom just isn’t true any more.

Near Los Angeles (and many/most big cities these days) even “fixer-upper””starter” homes cost $1,000,000.

5% down ($50k) would result in a monthly mortgage payment of $7,939.88 which more than twice my rent payment, which is already high.

And saving is nearly impossible given the rate at which the basic costs of living (including rent) have skyrocketed in recent decades.

It worked for me last year. Put 5% on a home near a major city, purchase price $425k

Some areas like LA are just a special kind of fucked, but you don’t have to live there.

Even at 425 PMI is killing you to the tune of an extra 300/ month

$61/mo actually.

Zero down also for USDA home loans