- cross-posted to:

- economics@lemmy.world

- cross-posted to:

- economics@lemmy.world

Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

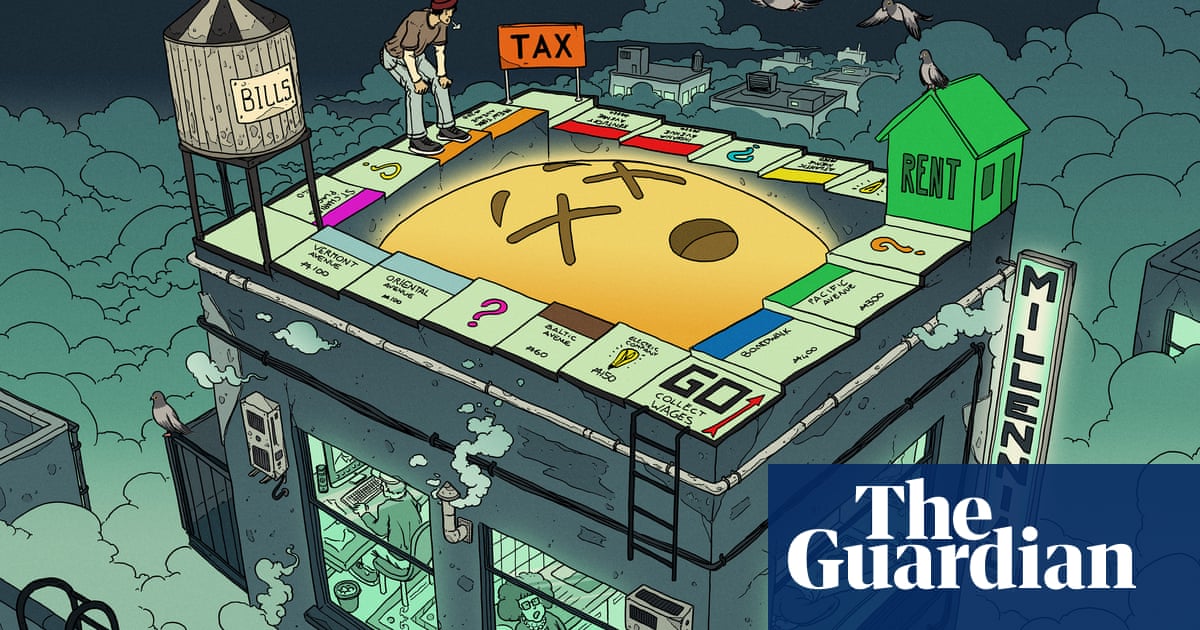

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

For the last 10 years when I’ve been asked about my career goals during job interviews I always respond, “I would like to retire.” I then clarify that I don’t mean tomorrow, next year, or even 5 years down the road. I just don’t want to die a wage slave.

What’s the typical reaction to that? Bring honest like that doesn’t sound like a winning strategy, unless you pass it off as a joke maybe.

I don’t say the wage slave part outright like that. I say the part about retiring with a smile like I’m joking but then use the opportunity to point out that I think about and plan for the future and that I’m financially responsible. Then I ask about the company’s benefits package.

Covid made thing weird for a while but my career has had a generally upward trend. My current job is a pretty serious step up for me in both salary and benefits and has a pretty clear path for future progression. I lost out on some of the creativity that I enjoyed in prior positions but I gained more free time to engage with my hobbies.

I’d say it’s been working for me but your mileage may vary based on your delivery and what kind of job you’re interviewing for.

Thanks for taking the time to answer!