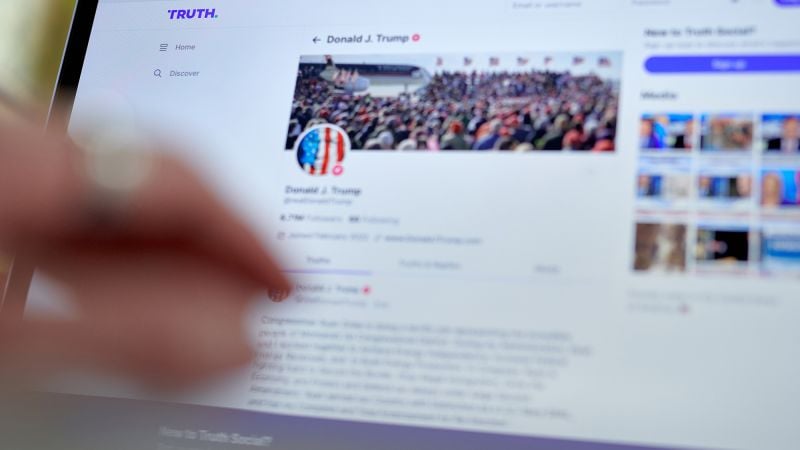

Trump Media & Technology Group, the owner of struggling social media platform Truth Social, is began its long-delayed journey as a public company at Tuesday’s opening bell under the ticker symbol “DJT.”

The stock surged about 56% at the open, to $78, and trading was briefly halted for volatility. Trump Media shares have since stabilized at around $70, marking a 40% increase from Monday’s close.

Wall Street is assigning Trump Media an eye-popping valuation of around $13 billion — a price tag that experts warn is untethered to reality.

The skyrocketing share price comes despite the fact that Trump Media is burning through cash; piling up losses; and its main product, Truth Social, is losing users.

“This is a very unusual situation. The stock is pretty much divorced from fundamentals,” said Jay Ritter, a finance professor at the University of Florida’s Warrington College of Business, who has been studying initial public offerings (IPOs) for over 40 years.

What’s the opposite of shorting and can you do that to a short?

The opposite of shorting a stock is buying a stock.

I’m not sure about that. I thought shorting was a promise to buy the stock for someone in the future, in return for the price now. That way if it goes down you make a profit. The real opposition of buying is not buying. Or maybe buying the compeditor.

You are describing a put option, a contract to sell the stock at the end date for whatever price is in the contract. The opposite is a call option, a contract to buy the stock at the set price.

Shorting and puts are a bit different. To short a stock, you borrow the shares and sell them today, then need to give back shares at a later date to the person you borrowed them from.

The opposite of buying is selling. When you buy, the price goes up and when you sell it goes down.

Normally you buy a stock before selling it. The opposite is selling a stock before buying it, which is known as shorting the stock.

Maybe this is worded funny, but you’re close. You sell it for it’s price today and then buy the same amount in the future for whatever it ends up being worth.

Shorting highly volatile securities is way more risky than shorting established low risk stocks. You could be on the hook for way more money than you’re able to pay back and since the value of DJT right now is completely unhinged it’s not subject to predictable market forces, industry trends, or conventional wisdom. It could go up to double, WSB could try a short squeeze, who knows.