A little dishonest not to mention that they fell by like 30% from 2017 to 2022. This feels more like a return to a pre-pandemic level.

Also odd that they ignore that the presentation they reference claims we should have fewer this year than 2019. (slide 40)

I’ve been screaming it practically at people that were seeing a ton of things returning to pre pandemic levels this year as a ton of government money/programs ran out. There’s going to be an adjustment for people where they freak out and think everything is a sign of a recession, but I’m just not seeing any of those same signs. That’s not to say things aren’t going great, but it’s definitely not like a lot of these articles where they try to sound an alarm that doesn’t need to be sounded.

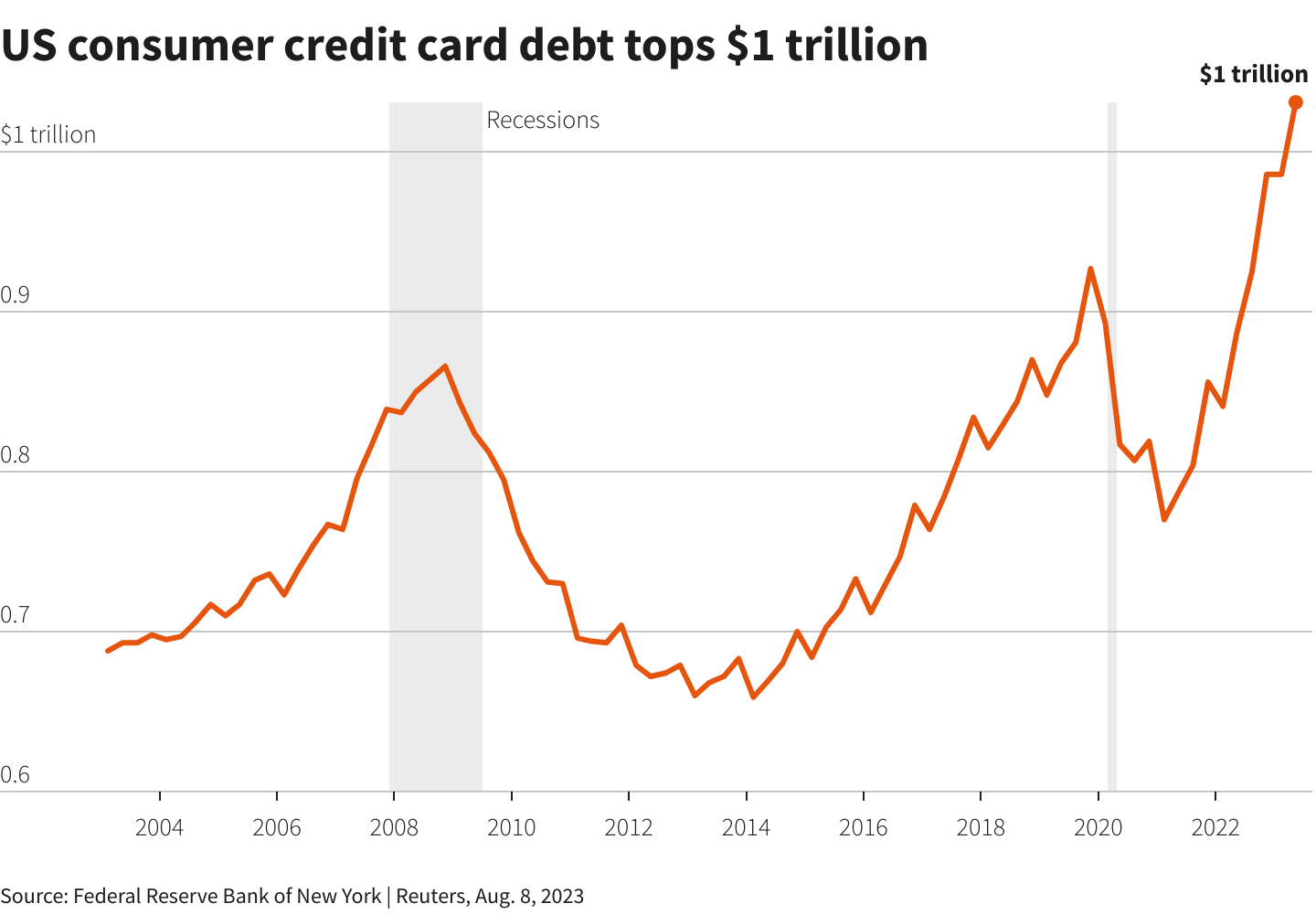

It is odd that so many people forgot about this. All “the sky is falling” posts about debt completely ignore this chart. What was weird was debt getting paid off during the pandemic. Not the rate of debt spending we’re back to post pandemic.

Could there be a Freddie Mac and Fannie Mae 2.0 coming in this case to automobiles?

Unlikely.

deleted by creator

Good news for the used car market. Lots of new inventory about to become available.

Bad news for American car manufacturers, who are already struggling while they’re in limbo between ICE and EV and can’t commit to either, but certainly will help to correct used car prices.

Don’t expect this to be a major economic factor to track going forward - many of these borrowers were likely already pushing their budget to afford the vehicle. If they financed with a variable rate while interest rates were rock bottom and government subsidies were peaking then this is exactly what you’d expect from the Fed rasing the interest rate.

Sure, some of these are due to unemployment and other circumstances but the major factor that changed was the prime interest rate, which can directly impact loan payments at a scale that is more directly measurable than something like unemployment, which is indirectly caused by the interest rate hike.

Commentators in the industry have been prognosticating about a subprime auto loan bubble burst for years and it keeps not happening, for whatever reason. Frankly I’m a bit surprised it hasn’t happened yet, but without some sort of engineered soft landing it feels like it has to be coming eventually. Car prices keep going up, loan terms keep getting longer, and the cost of borrowing is punishing right now. Negative equity in new loans keeps rising too. It’s only going to take a small systemic blip in people’s ability to pay to create a sudden spike in repossessions.